Medium- and heavy-duty vehicle electrification is a promising and emerging opportunity to reduce emissions, improve health, and save money. EV Hub has a variety of content on electric trucks and buses including public funding, private investment, and electric utility support for electric trucks and buses.

Statistics on this page are updated on a quarterly basis.

This page was last updated on April 1, 2022.

** EV Hub Users only

Key Findings from Our Research

FIND OUT MORE

Public and Private Investment

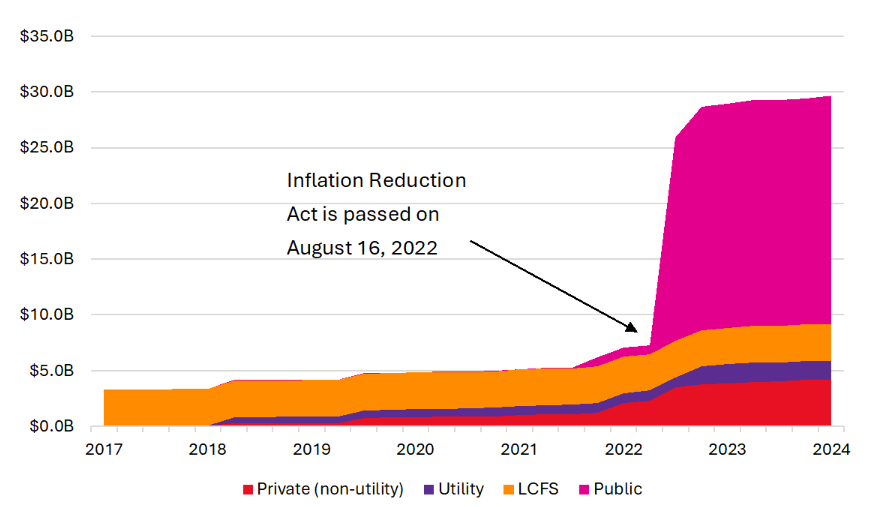

Public and private investment in electric trucks and buses is on the rise. See below for key stats on public, private, and utility investments in medium- and heavy-duty electrification through March 2022. The business case for electric buses and trucks is improving and private investment in the sector is increasing. Public funding will remain essential, however, for increased deployment of electric buses and trucks in the near term. Electric utilities will also play a major role in supporting the deployment of electric trucks and buses, primarily through charging infrastructure investment.

Public Funding

Public Funding in Electric Trucks in Buses (million $)

This chart draws on data from the State Policy Dashboard. Units are represented in million dollars.

Voucher Programs in California, New York, and New Jersey

- California Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project (HVIP): $1 billion

- New York Truck Voucher Incentive Program (NYTVIP): $58 million

- New Jersey Zero Emission Incentive Program (ZIP): $44.25 million

FIND OUT MORE

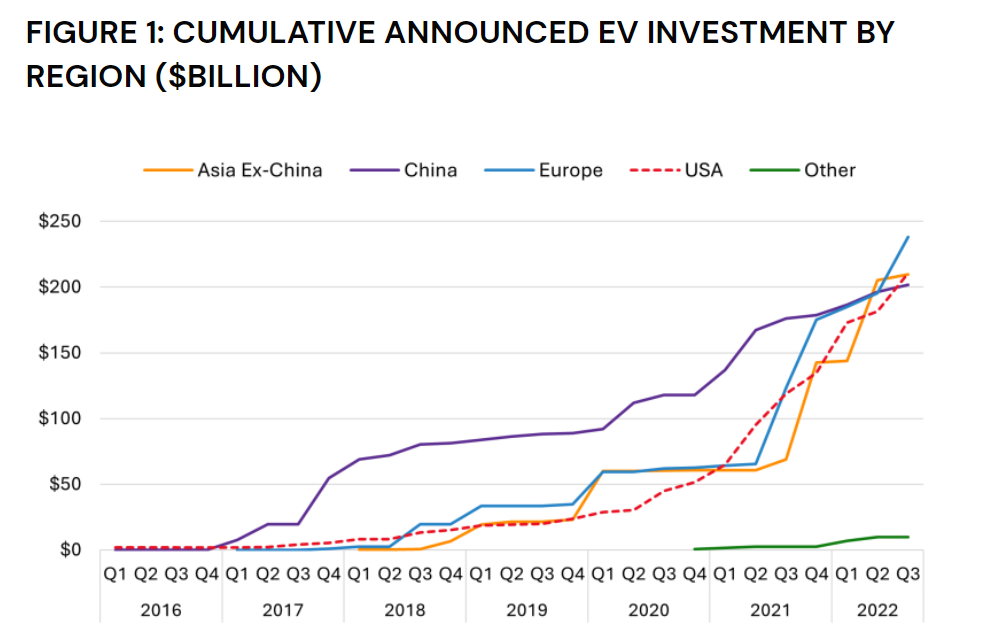

Global Private Investment

Global Private Investment in Electric Trucks and Buses

This chart draws on data from the Global Private Investment Dashboard. This includes funding outside of the United States.

FIND OUT MORE

Electric Utility Investment

Approved

Filed/Pending

Denied/Withdrawn

These data draws from the Electric Utility Filings Dashboard. The numbers above reflect programs with an electric bus and truck focus only.