Executive Summary

Introduction

Adoption of electric vehicles (EVs) in the United States has grown quickly, reaching more than one million EVs in 2023 sold through September. With unprecedented levels of customer demand, federal funding, policy action, and private sector investment advancing this technology, EVs are competing successfully against mainstream vehicles in an increasing number of markets.

As the pace of EV adoption accelerates, policymakers are paying closer attention to the methods of funding infrastructure fairly. Tax revenue from motor fuel has been a major contributor to federal funding for public highway infrastructure and accounts for nearly a third of funding on the state level. Currently, all 50 states and the District of Columbia (D.C.) collect a tax on gasoline, ranging from six cents per gallon (Alaska) to 61 cents per gallon (Pennsylvania), with the average tax being 27.1 cents per gallon. In recent decades, gas tax rates have not kept up with rising road construction and maintenance costs and increasing vehicle fuel economy, which has resulted in disproportionate attention on EVs as a source of declining revenue for transportation infrastructure.

For more than a decade, states have attempted to reconcile losses of gas tax revenue from EVs through additional fees, and some have recently added new taxes for public charging services. Recent research by Atlas Public Policy, however, finds that the current impact of increasing EV adoption on road funding is marginal and that EV drivers are disproportionally faced with more taxes and fees than drivers of gas-powered vehicles.

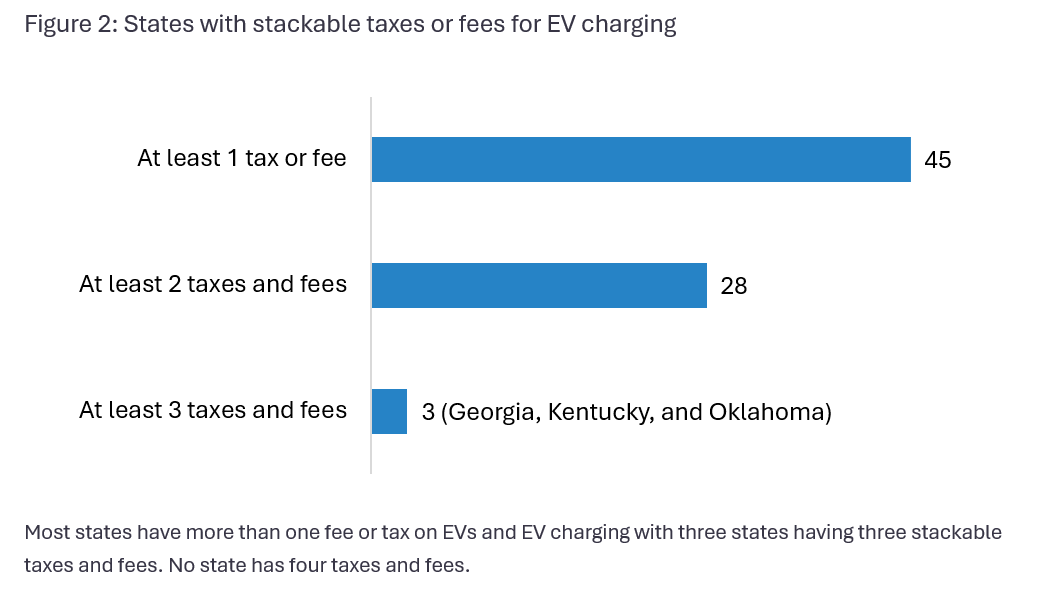

Currently, EV drivers are subject to a wide array of taxes and fees, including registration fees and charging taxes — either by taxing electricity by the unit of energy (kilowatt-hour) or at the retail cost or by imposing a sales tax (or sales tax equivalent) on electricity sold at public EV charging stations. No attempt to collect and present this information altogether has previously been made. There is no structure preventing the overlapping of these fees, so EV drivers can unfairly be double or triple taxed, fostering an inequity that drivers of gasoline-powered vehicles do not encounter. As the technology scales to more price points and the used EV market expands, this will increasingly become an affordability issue, particularly for people who do not have ready access to home charging and have no choice but to use publicly available DC fast chargers.

Given the competing taxation structures between gasoline and electric vehicles, this data story attempts to contextualize the entire landscape of EV and public charging taxes and fees in the United States and provide a comparative analysis of how they stack up against fees levied upon drivers of gasoline-powered vehicles. Doing so will broaden the discussion of “fairness” when it comes to EV drivers’ contribution to road funding.

Electric Vehicle Fees: State of Play

To help fund road infrastructure, EV drivers are generally subject to two fees: annual EV-specific registration fees and taxes on public EV charging, either by taxing electricity on a unit of energy basis and/or as a share of the retail price. It must be noted that all drivers pay a vehicle registration fee; in many states, EV drivers pay another fee on top of this in most states. It should also be noted that this additional fee is due at the same time registration is paid, so the registration bill for an EV can be hundreds of dollars, which may pose another barrier for low- and moderate-income people looking to purchase an EV. Additionally, depending on how a state treats electricity, EV drivers can be subject to other taxes not intended for road infrastructure, such as sales or electricity taxes. These taxes then go into the general fund, not into transportation budgets. Currently, there is no structure to prevent the overlapping of these fees, so EV drivers may be subject to a double, triple, or a quadruple tax depending on what state they reside in and where they charge. Meanwhile gasoline drivers are only subject to the gasoline tax and are generally exempt from sales or other taxes.

In our “Closing the Road Funding Gap” report, we collected data on EV registration fees and kilowatt-hour fees on EV charging. Around 34 states charge battery electric vehicle (BEV) drivers additional registration fees, ranging from $50 (Hawaii and South Dakota) to $225 (Washington) with the average fee costing $132.58, and 28 of these states charge an additional registration fee for plug-in hybrid vehicles (PHEV). See Table 1 for a summary of the EV and taxes fees compared to gasoline vehicles.

Table 1: Summary statistics of EV charging taxes and fees

|

Fee/Tax |

Average |

Median |

Minimum |

Maximum |

|

BEV Fee ($/year) |

$132.58 |

$126.99 |

$50.00 |

$225.00 |

|

Kilowatt-hour Tax ($/kWh) |

$0.033 |

$0.030 |

$0.018 |

$0.070 |

|

Sales/Use/General Tax (%) |

5.52% |

6.00% |

2.90% |

7.00% |

|

Electricity/Utility Tax (%) |

3.80% |

3.80% |

2.60% |

5.00% |

|

EV Fee ($/mile) |

$0.014 |

$0.013 |

$0.000 |

$0.034 |

|

Gasoline ($/gallon) |

$0.271 |

$0.260 |

$0.040 |

$0.611 |

|

Gasoline ($/mile) |

$0.008 |

$0.007 |

$0.001 |

$0.017 |

Furthermore, at least seven states have in place taxes, either by the kilowatt-hour or the retail price of electricity, on energy use at public EV charging stations. For example, Utah charges a 12.5 percent tax on public EV charging services. Electrify America stations cost $0.56 per kilowatt-hour in the state making Utah EV drivers pay an additional seven cents per kilowatt hour—the largest in the country.

The latter type of fee, a sales or gross receipts tax on public EV charging, is more nuanced and requires an understanding of how EV charging stations are regulated at the state level. Because an EV charging station’s capacity to furnish electricity to end-use customers is traditionally the role of a public utility, policymakers have worked to distinguish EV service providers from utilities through legislative or regulatory action. According to Atlas EV Hub’s policy tracker, only Louisiana, Nebraska, Tennessee, and Wisconsin have not legally defined EV charging service providers as separate from a public utility. In 46 states and the District of Columbia, their electricity services are not subject to the jurisdiction of the public service commission and are entitled to separate tax treatment.

Figure 2 shows the number of states where EV drivers face a different amount of stackable taxes. A complete table of fees or taxes on a state-by-state basis can be found in the Appendix. See Box 1 for our assumptions on how taxes are classified.

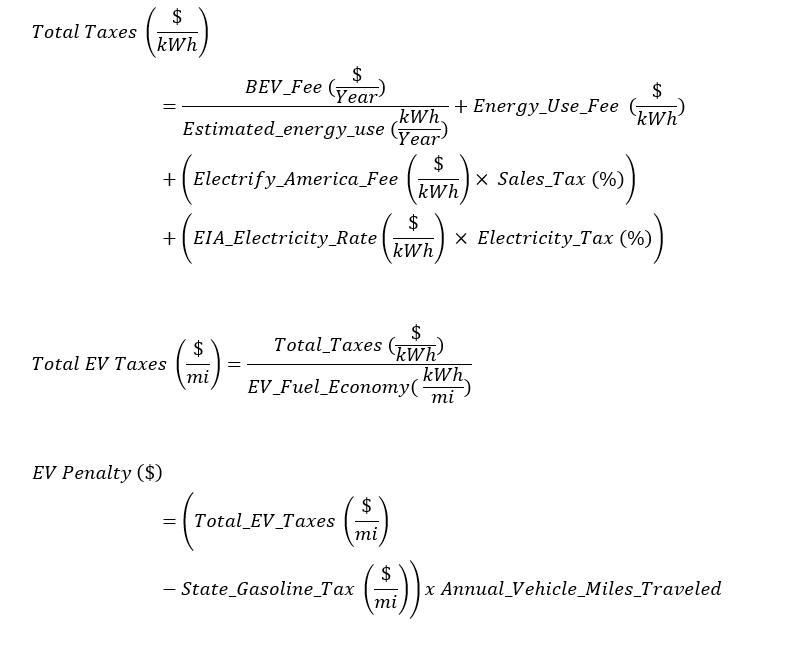

Identifying the “EV Penalty” compared to gasoline vehicles

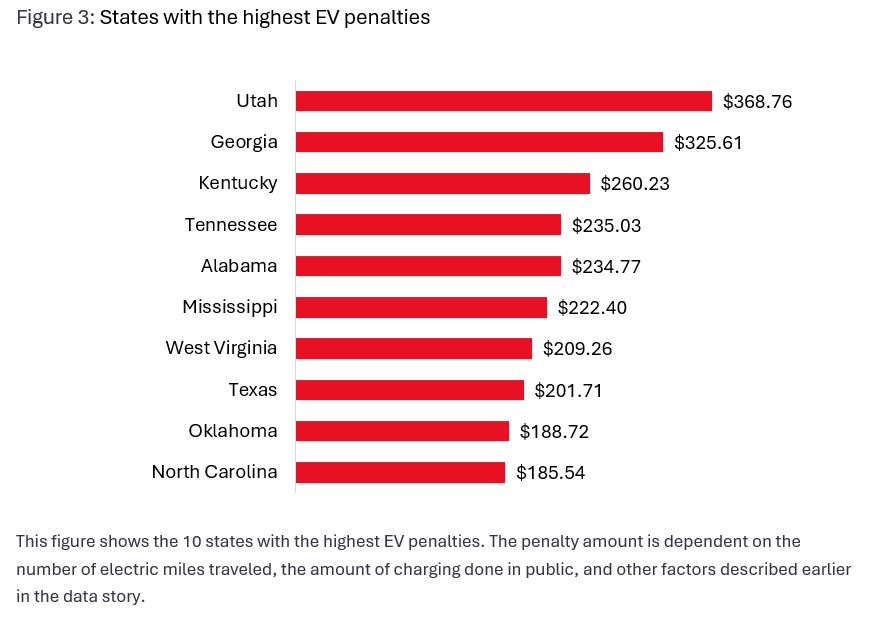

To understand the accumulation of taxes on EVs and charging, we computed an “EV Penalty” using the formulas provided in the Appendix. The EV Penalty is the total amount of EV-specific taxes and fees an EV driver pays in a single calendar year for each state in comparison to a typical gasoline vehicle driver. The estimate assumed vehicles travel 12,000 miles per year, with EVs getting three miles per kilowatt-hour and gasoline vehicles getting 35 miles per gallon. Importantly, we also assumed a driver is charging only at Electrify America stations because of the charging company’s nationwide network; while most charging is done at home today, many potential new EV drivers will not have ready access to home charging because they park on the street, are renters, or otherwise do not have easy access to power where they park. As such, the illustration presented here does not reflect the experience for drivers who have ready access to home charging. This challenge is especially present for low-income households and those in disadvantaged communities.

The results show that EV drivers in 36 states, including the District of Columbia, pay more in taxes and fees when compared to drivers of gasoline-powered vehicles in a single calendar year. Of these 36 states, 16 pay more than a $150 EV Penalty. The average EV penalty for all states is $79.24 and the median penalty is $73.07. An EV driver in Georgia, for example, can pay more than $300 in taxes and fees, from the state’s BEV registration fee of $210, a public charging tax of 2.8 cents per kilowatt-hour, and a sales tax of four percent on the electricity they purchase at EV charging stations.

EV drivers in 15 states pay less in taxes and fees than drivers of gas-powered vehicles, ranging from $0.69 per year in Maine up to $119.49 in Oregon, as shown in Table 2 in the Appendix. These states span the country and have noticeably lower taxes and fees for EV drivers: five have annual fees on EVs, none have a per-kilowatt hour tax on public charging, four have sales or general use taxes, and only one has a utility tax. EV drivers in these states can save money, which can act as a small incentive to own an EV, though these savings are low relative to states with the highest EV Penalty.

Policymakers should bring balance to EV and charging tax treatment

A lack of transparency exists on the taxes that end-users pay at public EV charging stations. The research we conducted on the EV charging taxes was complicated, requiring us to follow the assumptions laid out in Box 1 for our data collection. Most states do not clearly define the taxability of electricity at EV charging stations; Florida and Georgia are exceptions. Even when we asked tax policy officials, we received inconclusive results in some cases. States should define and make this information accessible for the sake of tax literacy for both EV drivers and charging providers.

Next, tax policy has not kept up with the rapid pace of EV adoption in the United States whether that be how EVs contribute to road funding equitably or how EV charging is taxed. Over a million EVs have been sold in the United States through September of 2023, and EVs are expected to make up a large share of vehicle purchases as the decade advances, possibly reaching a majority of sales later in the decade in some markets.

Moreover, this research made visible a tax gap between public and private EV charging. Since residential charging is exempt from the taxes stated in this report and is subject to owner’s home utility bill, the disproportionate taxation at public charging creates an inequity for people who cannot afford a home charger or otherwise don’t have easy to access to charging where they park.

Finally—and most concerning—EV drivers are unfairly taxed in comparison to drivers of gasoline-powered vehicles in most of the country. EV drivers in these states pay more in EV-specific fees and charging taxes when compared to gasoline vehicle drivers, resulting in a tax inequity. While some states may offer a tax credit for those who are double-taxed, the presence of the credit may not be widely known and claiming the credit would require drivers to accumulate records of all public charging sessions, which could be onerous. Despite increasing EV adoption having a marginal impact on road funding revenue, states’ structure of taxing EVs is yielding an inequity. Policymakers should consider fair funding mechanisms that contribute to public road funding and do not adversely impact EV drivers.

Appendix

Below are the formulas used to calculate the EV Penalty.

Table 2: Gas and EV fees and EV Penalty

|

State |

State Gas Tax ($/mi) |

BEV Registration Fee ($/year) |

Fee ($/kWh) |

Sales/ Use/ General Tax |

Electricity/ Utility Tax |

EV Penalty ($) |

Notes |

|

Alabama |

$0.002 |

$203.00 |

$0.000 |

4.00% |

0.00% |

$234.77 |

|

|

Alaska |

$0.005 |

$0.00 |

$0.000 |

0.00% |

0.00% |

-$61.71 |

|

|

Arizona |

$0.007 |

$0.00 |

$0.000 |

5.60% |

0.00% |

$23.18 |

|

|

Arkansas |

$0.017 |

$200.00 |

$0.000 |

6.50% |

0.00% |

$126.29 |

|

|

California |

$0.007 |

$108.00 |

$0.000 |

0.00% |

0.00% |

$22.29 |

|

|

Colorado |

$0.007 |

$62.47 |

$0.000 |

2.90% |

0.00% |

$41.72 |

Indexed annually to NHCCI. |

|

Connecticut |

$0.007 |

$0.00 |

$0.000 |

0.00% |

0.00% |

-$78.86 |

|

|

Delaware |

$0.007 |

$0.00 |

$0.000 |

0.00% |

0.00% |

-$80.57 |

|

|

District of Columbia |

$0.001 |

$0.00 |

$0.000 |

6.00% |

0.00% |

$101.49 |

|

|

Florida |

$0.009 |

$0.00 |

$0.000 |

4.35% |

2.60% |

-$9.93 |

|

|

Georgia |

$0.005 |

$210.87 |

$0.028 |

4.00% |

0.00% |

$325.61 |

Registration fee adjusted annually based on average fuel economy and inflation. |

|

Hawaii |

$0.009 |

$50.00 |

$0.000 |

0.00% |

0.00% |

-$59.71 |

|

|

Idaho |

$0.013 |

$140.00 |

$0.000 |

0.00% |

0.00% |

-$15.66 |

|

|

Illinois |

$0.010 |

$95.68 |

$0.000 |

0.00% |

5.00% |

$5.84 |

Estimated weighted average fee based on EV sales. $100 fee excludes vehicles weighing >8,000 lbs. |

|

Indiana |

$0.009 |

$150.00 |

$0.000 |

7.00% |

0.00% |

$181.54 |

|

|

Iowa |

$0.007 |

$130.00 |

$0.026 |

0.00% |

0.00% |

$151.71 |

|

|

Kansas |

$0.008 |

$60.00 |

$0.000 |

6.50% |

0.00% |

$57.80 |

Flat fee of $100 for BEVs and $50 for PHEVs/HEVs compared to fees of $40/$30 for conventional vehicles over/under 4,500 lbs. Figures shown are the fee difference for an EV over 4,500 lbs compared to a conventional counterpart of the same weight. |

|

Kentucky |

$0.006 |

$120.00 |

$0.030 |

6.00% |

0.00% |

$260.23 |

All effective 1/1/24 and indexed annually to NHCCI. EV charging tax is $0.06/kWh when on state property. |

|

Louisiana |

$0.009 |

$110.00 |

$0.000 |

4.45% |

0.00% |

$92.58 |

|

|

Maine |

$0.009 |

$0.00 |

$0.000 |

5.50% |

0.00% |

-$0.69 |

|

|

Maryland |

$0.007 |

$0.00 |

$0.000 |

6.00% |

0.00% |

$32.91 |

|

|

Massachusetts |

$0.008 |

$0.00 |

$0.000 |

6.25% |

0.00% |

$21.94 |

|

|

Michigan |

$0.008 |

$154.25 |

$0.000 |

6.00% |

0.00% |

$171.74 |

Estimated weighted average fees based on EV sales. BEV fees are $248/$148 for vehicles over/under 8,000 lbs. |

|

Minnesota |

$0.005 |

$75.00 |

$0.000 |

6.88% |

0.00% |

$145.38 |

|

|

Mississippi |

$0.007 |

$172.00 |

$0.000 |

7.00% |

0.00% |

$222.40 |

|

|

Missouri |

$0.009 |

$105.00 |

$0.000 |

4.23% |

0.00% |

$73.07 |

|

|

Montana |

$0.008 |

$144.53 |

$0.030 |

0.00% |

0.00% |

$165.10 |

Estimated weighted average registration fees based on EV sales. BEV/PHEV fees are $130/$70 for vehicles under 6,000 lbs and $190/$100 for vehicles 6,000-10,000 lbs. |

|

Nebraska |

$0.007 |

$75.00 |

$0.000 |

5.50% |

0.00% |

$77.54 |

|

|

Nevada |

$0.006 |

$0.00 |

$0.000 |

0.00% |

0.00% |

-$76.11 |

|

|

New Hampshire |

$0.003 |

$0.00 |

$0.000 |

0.00% |

0.00% |

-$36.00 |

|

|

New Jersey |

$0.005 |

$0.00 |

$0.000 |

6.63% |

0.00% |

$69.01 |

|

|

New Mexico |

$0.002 |

$0.00 |

$0.000 |

5.00% |

0.00% |

$84.57 |

|

|

New York |

$0.012 |

$0.00 |

$0.000 |

4.00% |

0.00% |

-$62.06 |

|

|

North Carolina |

$0.007 |

$130.00 |

$0.000 |

7.00% |

0.00% |

$185.54 |

|

|

North Dakota |

$0.011 |

$120.00 |

$0.000 |

0.00% |

0.00% |

-$12.00 |

|

|

Ohio |

$0.005 |

$200.00 |

$0.000 |

0.00% |

0.00% |

$134.86 |

|

|

Oklahoma |

$0.011 |

$112.61 |

$0.030 |

4.50% |

0.00% |

$188.72 |

Estimated weighted average registration fees based on EV sales. BEV fees are $158/$110 for vehicles over/under 6,000 lbs. |

|

Oregon |

$0.017 |

$90.00 |

$0.000 |

0.00% |

0.00% |

-$119.49 |

|

|

Pennsylvania |

$0.010 |

$0.00 |

$0.018 |

6.00% |

0.00% |

$70.63 |

|

|

Rhode Island |

$0.008 |

$0.00 |

$0.000 |

0.00% |

0.00% |

-$96.00 |

|

|

South Carolina |

$0.008 |

$60.00 |

$0.000 |

6.00% |

0.00% |

$79.20 |

|

|

South Dakota |

$0.007 |

$50.00 |

$0.000 |

4.20% |

0.00% |

$28.06 |

|

|

Tennessee |

$0.006 |

$200.00 |

$0.000 |

7.00% |

0.00% |

$235.03 |

|

|

Texas |

$0.010 |

$200.00 |

$0.000 |

6.25% |

0.00% |

$201.71 |

|

|

Utah |

$0.003 |

$130.25 |

$0.070 |

0.00% |

0.00% |

$368.76 |

|

|

Vermont |

$0.009 |

$0.00 |

$0.000 |

6.00% |

0.00% |

-$10.97 |

|

|

Virginia |

$0.014 |

$123.98 |

$0.000 |

0.00% |

0.00% |

-$45.39 |

|

|

Washington |

$0.006 |

$225.00 |

$0.000 |

0.00% |

0.00% |

$154.71 |

|

|

West Virginia |

$0.009 |

$200.00 |

$0.000 |

6.00% |

0.00% |

$209.26 |

|

|

Wisconsin |

$0.007 |

$100.00 |

$0.000 |

5.00% |

0.00% |

$95.14 |

|

|

Wyoming |

$0.008 |

$200.00 |

$0.000 |

4.00% |

0.00% |

$166.30 |

|