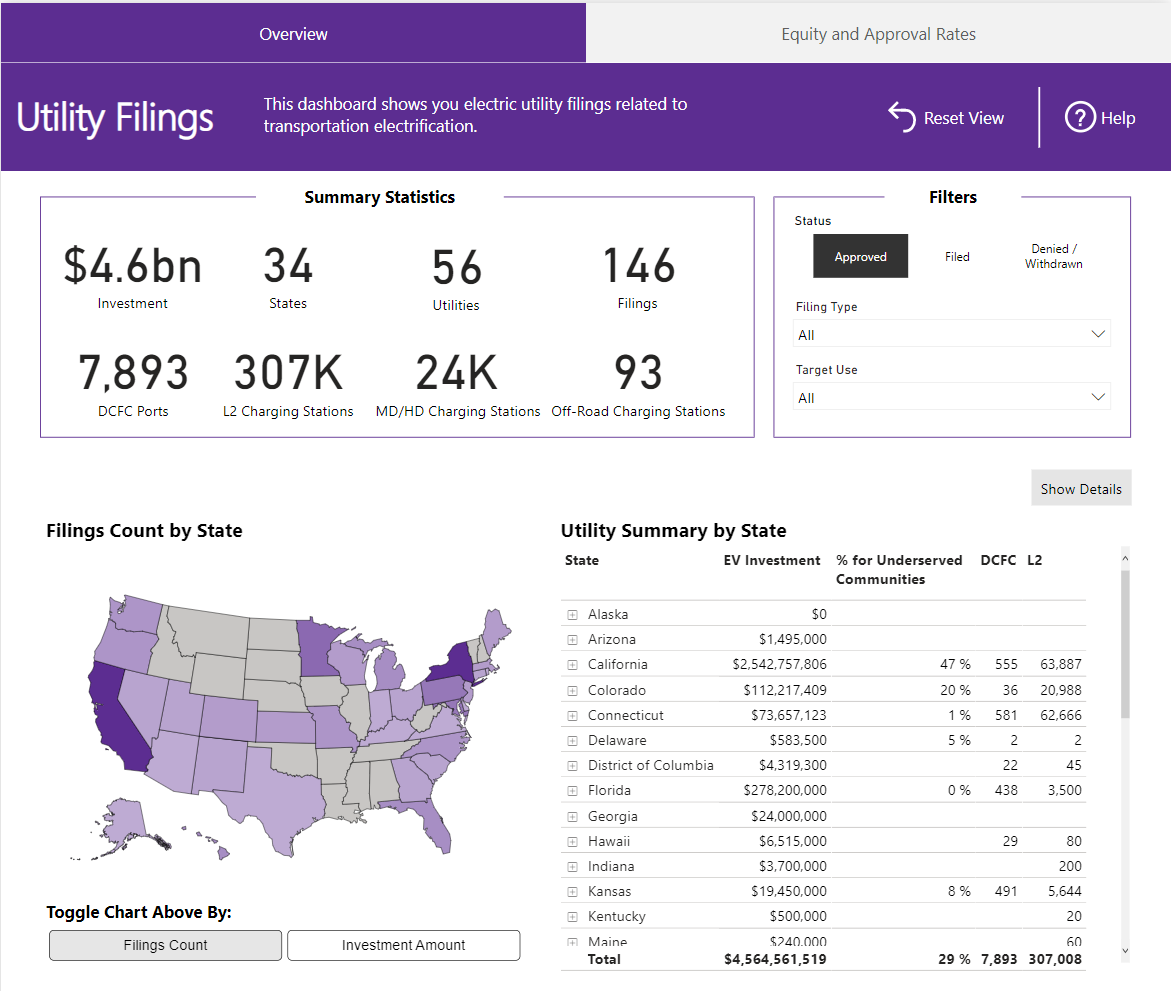

To-date, investor-owned utilities (IOUs) have been approved to invest more in transportation electrification than the total funding from state and local governments. IOUs have been approved to invest more than $3.3 billion in things like charging infrastructure, EV education and awareness, and in some cases vehicle purchases. For comparison, state and local governments have awarded about $2.7 billion to date. That makes IOUs a key source of funding and makes it essential that they design their programs to support equitable outcomes. Through November 2021, $775 million – about 23 percent of the total $3.3 billion in approved IOU investment – has been committed to underserved communities.

The second half of 2021 saw a decrease in the percentage of approved funding carved out for underserved communities. Among programs that included carveouts, the percentage came to about five percent of approved investments compared to about 28 percent for the first half of the year. While this is a substantial decrease, it is important to note that carveouts are not the only way to prioritize equity. Some other methods include offering higher rebates for income-qualified customers, created targeted education and outreach programs, or including equity considerations in selection criteria for choosing charging sites. With these other means of prioritizing equity in mind, it is notable that every program approved during the second half of 2021 included a focus on equity. And since 2012 when IOUs started establishing transportation electrification programs, about 50 percent of approved programs include some kind of focus on underserved communities.

Two programs approved during the second half of 2021 in New Mexico from PNM and Xcel are worth highlighting for their strong equity provisions. For both programs, the Public Regulation Commission approved stronger equity terms than those originally proposed by the utilities. Based on recommendations from a variety of stakeholders, the approved programs from PNM and Xcel included higher rebates and new budget carve-outs for underserved communities.1 This is not the first time we have seen commissions approve programs with stronger equity commitments than originally proposed. Back in 2019, the California Public Utilities Commission required all three of California’s largest IOUs – PG&E, SCE, and SDG&E – to increase their charger commitments to underserved communities in their Charge Schools programs. And in a recent $110 million program approved for Xcel Energy in Colorado, the Colorado Public Utilities Commission increased the percentage of the budget committed to underserved communities in several program elements, approving a minimum commitment of 15 percent of the overall program budget for underserved communities.2

There were also some notable equity provisions in programs that were proposed during the second half of 2021 and are still pending a commission decision. One such provision was a unique Equity Performance Incentive Mechanism (PIM) proposed by Xcel Energy in Colorado in its 2021-2023 Transportation Electrification Plan. If approved, the Equity PIM will provide up to $1.5 million in incentives to Xcel for meeting charging deployment and educational targets in underserved communities. In addition, PG&E proposed a $276 million program to support on-site and off-site charging options for multifamily housing residents with a 50 percent target for underserved communities. 50 percent is a high target even for California IOUs, which have been leaders with regard to designing equity-focused programs. Table 1 below summarizes approved utility investment planned for underserved communities through November 2021.

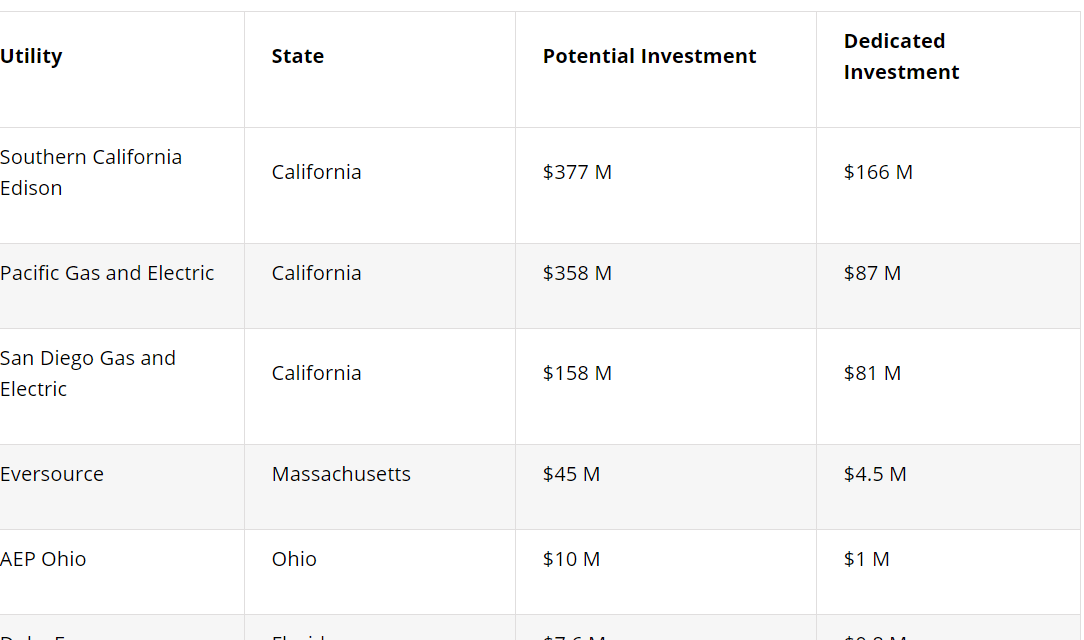

Table 1: Approved Investor-Owned Utility Investments Planned for Underserved Communities Through November 2021

|

Utility |

State |

Total Investment ($ millions) |

Investment Planned for Underserved Communities ($ millions) |

Percent Allocated to Underserved Communities |

|

Southern California Edison |

CA |

$872 |

$391.1 |

45% |

|

Pacific Gas & Electric Company |

CA |

$421 |

$95.1 |

23% |

|

New York State Energy and Research Development Authority (NYSERDA) Environmental Justice Grants3 |

NY |

$85 |

$85.0 |

100% |

|

San Diego Gas & Electric |

CA |

$238 |

$70.1 |

29% |

|

Consolidated Edison Company |

NY |

$356 |

$47.3 |

13% |

|

National Grid |

NY |

$160 |

$23.4 |

15% |

|

Xcel Energy |

CO |

$110 |

$21.9 |

20% |

|

New York State Electric & Gas Corporation |

NY |

$87 |

$12.8 |

15% |

|

Rochester Gas and Electric Corporation |

NY |

$48 |

$6.5 |

14% |

|

Eversource |

MA |

$45 |

$4.5 |

10% |

|

Central Hudson Gas & Electric Corporation |

NY |

$34 |

$4.2 |

13% |

|

Orange and Rockland Utilities |

NY |

$28 |

$3.9 |

14% |

|

Portland General Electric |

OR |

$14 |

$2.7 |

19% |

|

PNM |

NM |

$9 |

$2.2 |

24% |

|

Eversource |

CT |

$74 |

$1.0 |

1% |

|

Duke Energy |

FL |

$71 |

$0.8 |

1% |

|

Potomac Edison |

MD |

$7 |

$0.5 |

7% |

|

Puget Sound Energy |

WA |

$21 |

$0.4 |

2% |

|

Ameren Missouri |

MO |

$11 |

$0.4 |

4% |

|

AEP Ohio |

OH |

$10 |

$0.4 |

4% |

|

Tampa Electric |

FL |

$2 |

$0.3 |

12% |

|

Pacific Power |

WA |

$2 |

$0.2 |

14% |

|

National Grid |

MA |

$30 |

$0.2 |

1% |

|

Duquesne Light Company |

PA |

$3 |

$0.2 |

7% |

|

Liberty Utilities |

CA |

$11 |

$0.2 |

1% |

|

Delmarva Power |

DE |

$1 |

<$0.0 |

5% |

|

Programs with no carveout for underserved communities |

N/A |

$550 |

$0 |

0% |

|

Total |

$3,300 |

$775 |

23% |

This table summarizes approved investor-owned utility investment in transportation electrification planned for underserved communities through November 2021. 23% of approved funding is targeted for underserved communities.

Source: EV Hub Utility Filing Dashboard

Atlas has tracked proposed and approved IOU transportation electrification programs since 2012, with the first approved program logged in 2013. Over the past year, we have been digging through utility progress reports to start to learn about how the implementation of these approved programs is going. So far, Atlas has been able to find and review utility reports on the implementation of 50 programs across 17 states.4 We wrote about several key findings from this sample in a data story in September. Of the 50 programs for which we found and reviewed progress reports, 16 programs reported data on charger deployments in underserved communities. Of these 16 programs, at least six programs were exceeding their commitments, in many cases by more than 100 percent. Notably, this does not imply that the other ten programs will not meet or exceed their commitments because these results are just a snapshot, as not all utilities are required to issue progress reports, and many programs are still in their early years. Still, these early results are positive, and show that designing programs to prioritize investment in underserved communities can help to ensure charger deployment in these communities.

California programs made up more than 95 percent of the reported chargers in underserved communities. Again, it is important to note that not all utilities report data on charger installations in underserved communities, so this does not imply that 95 percent of utility-supported chargers in underserved communities are from California utilities. Still, California utilities have led in terms of designing programs to ensure equitable benefits. To date, California programs account for about 70 percent of approved funding allocated to underserved communities. However, utilities in other states have been catching up for a while. In fact, in 2021, six states other than California – Colorado, Florida, New Jersey, Connecticut, Nevada, and New Mexico – had programs approved with equity-focused components. Colorado utilities ranked first in 2021 in terms of total investment committed to undeserved communities, with more than $21.9 million allocated. California came in second with $20.8 million and New Mexico, Connecticut, and Florida ranked third, fourth, and fifth, respectively, with a combined $3.5 million.

Since the role of IOUs in supporting transportation electrification has largely involved investing in charging infrastructure, IOUs looking to design equitable programs have focused on ensuring chargers get built in underserved communities. However, it is extremely important to have complementary policies from government players at the state, local, and federal levels to help make EVs more affordable to purchase. The success of policies like the EV tax credits in the proposed Build Back Better bill will have a meaningful impact on how well IOU programs end up serving underserved communities. As of the time this data story was written, the fate of Build Back Better is very unclear, after Senator Joe Manchin stated he would not support the bill.

1 The PNM program referenced is the 2022-2023 Transportation Electrification Plan (docket 20-00237-UT). The Xcel program referenced is the 2021-2022 Transportation Electrification Plan (docket 20-00150-UT).

2 The Xcel program referenced is the 2021-2023 Transportation Electrification Plan (docket 20A-0204E).

3 These programs are funded through electric ratepayer revenue, however, NYSERDA rather than the utilities is responsible for using the funds and implementing the EJ Grant programs. These programs are detailed in the July 16, 2020 New York Public Service Commission Order in Case 18-E-0138.

4 Atlas finds and reviews reports associated with approved investor-owned utility transportation electrification programs. Not all approved utility programs have issued public reports and not all reports include the same information (e.g., not all reports include cost data or charger deployment data) so the information in this data story does not represent a comprehensive summary of implemented utility transportation electrification programs.

Learn More