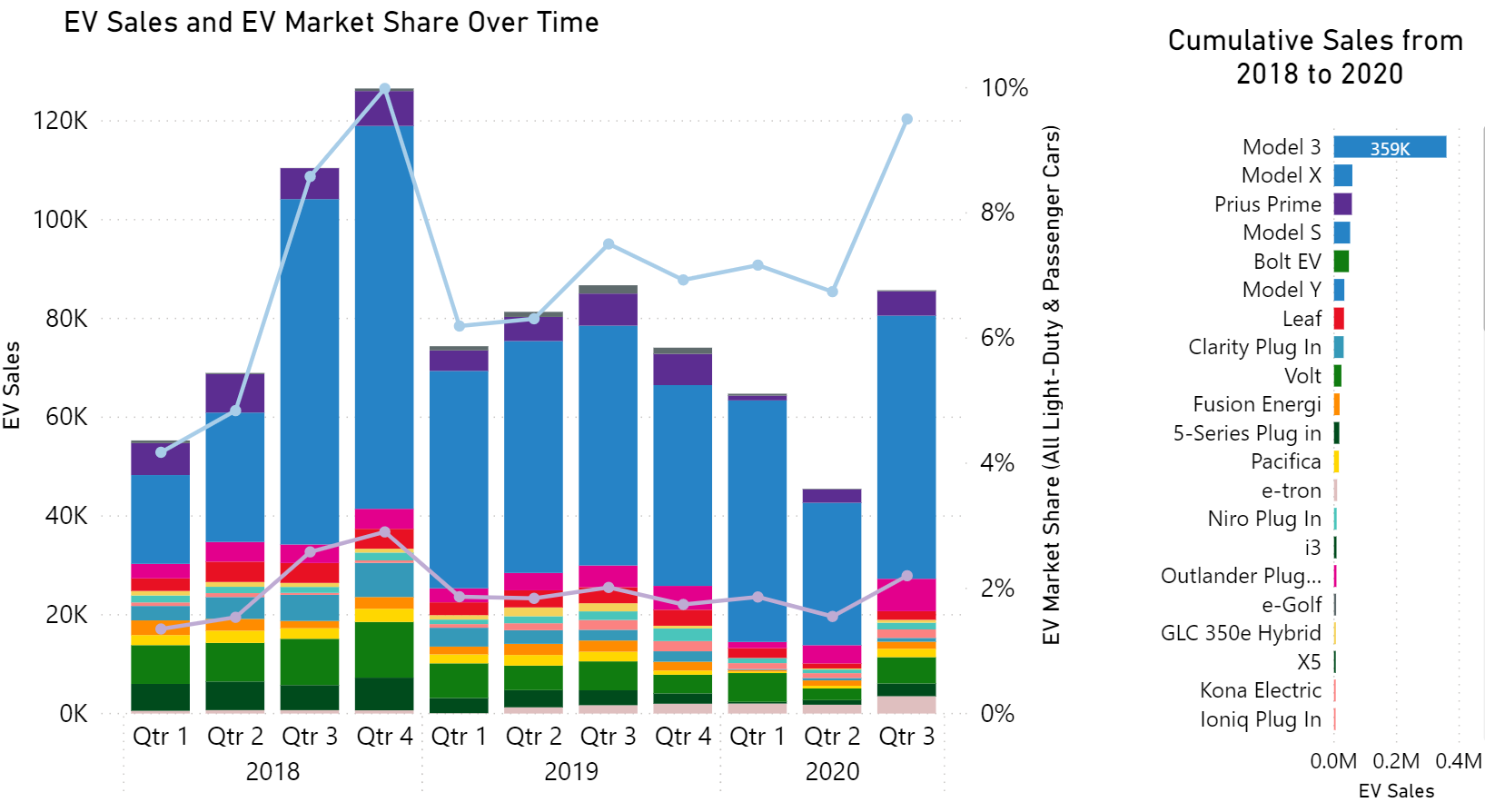

Source: EV Hub

The U.S. EV market rebounded in the third quarter with total quarterly sales only two percent below the numbers from 2019. Monthly sales were up 20 percent in September compared to 2019, the first month in 2020 where there was year-over-year growth. Adding in the third quarter sales figures reduces the year-to-date decline for the EV market from 29 percent through the end of June to 19 percent through September. Between January and September, the auto sector as a whole is down by 17 percent.

In the third quarter, Tesla claimed 62 percent of the total sales. The Model Y, which entered production in March, sold 25,800 units between July and September and overtook the Model 3 as the most popular EV on the market. Overall, 12 vehicle brands sold more than 1,000 EVs in the third quarter, up from just seven in the second quarter. GM saw sales for the Chevy Bolt more than double between the second and third quarters.

Strong sales for the Bolt have helped GM retain the number two position in the U.S. passenger EV market. The automaker is looking to catch Tesla and increase their lead over the rest of the field by accelerating investments in their EV program. On November 19th, the company announced an increased commitment of $27 billion to bring 30 new vehicles to market through 2025. While GM leads the other major American automakers in terms of announced electrification commitments, Ford is second in line and has announced plans for more than $3.5 billion in specific investments in American EV manufacturing this year. In total, automakers have committed $23.5 billion in direct investment for domestic EV manufacturing across 11 states supporting roughly 40,000 jobs.

New EV models are on the horizon and legacy manufacturers around the globe face increasing competition from EV startups. In China, EV manufacturers Li Auto, Xpeng Motors, and NIO have all seen stock prices reach record highs in November. Tesla stock exceeded $500 a share today as the company prepares to enter the S&P 500 in December. Stock market success for passenger EVs is boosting the medium- and heavy-duty electrification market as well. U.K-based bus and delivery truck startup, Arrival is planning to list on the U.S. market through the reverse merger track taken by several other manufacturers including Nikola in 2020.

All of this has unfolded over the top story of this week – the unveiling of the Zero Emission Transportation Association (ZETA). ZETA plans to advocate for policies to ensure all new light-, medium-, and heavy-duty vehicle sales are zero emission by 2030. The group, which includes stakeholders like Tesla, Uber, ChargePoint, Proterra, and Rivian as well as a slew of major electric utilities, seeks to advocate for broad infrastructure support, tougher emissions standards, and point-of-sale incentives for EVs to encourage widespread adoption. ZETA also plans to secure increased federal support for electrification. There are several pathways for federal leadership to expand as the country welcomes the climate-focused Biden administration in January. For a deeper dive on the what lies ahead in the transportation landscape at the federal and state level, watch our recent conversation with Dan Sperling on EV Hub Live.