|

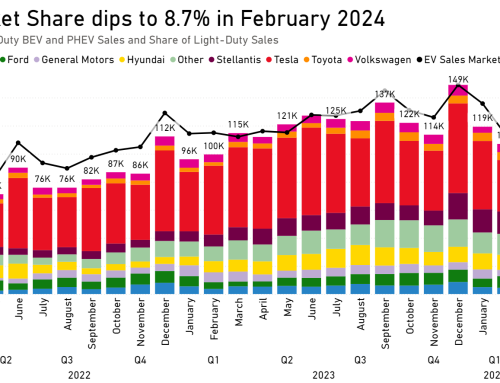

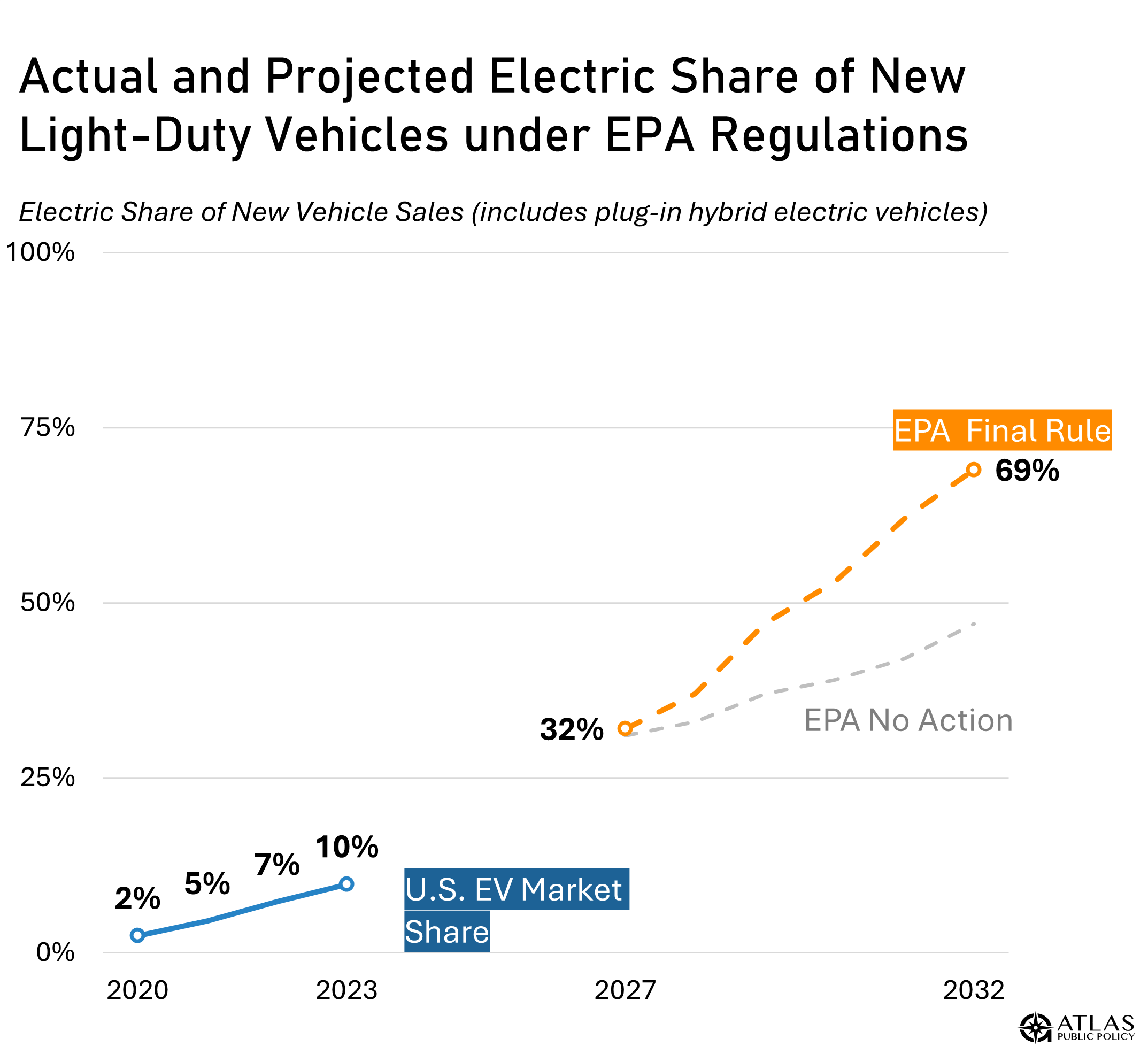

Last week, the Environmental Protection Agency (EPA) announced the final standards to regulate the emissions of new light- and medium-duty vehicles sold in the United States, a move that aims to drastically minimize the impact of air pollution resulting from motor vehicles on public health and the climate. The final rule enforces the strongest-ever vehicle pollution standards, and according to EPA administrator Michael Regan, these standards “will slash over seven billion tons of climate pollution, improve air quality in overburdened communities, and give drivers more clean vehicle choices while saving them money.” These regulations will be gradually implemented from model years 2027 to 2032. Beginning in model year 2027, manufacturers of light- and medium-duty cars and trucks will need to comply with new emissions requirements by rapidly increasing the sale of near or zero-emission vehicles, or by purchasing credits from other manufacturers. The regulation is set to bring significant changes to the auto industry, potentially putting the United States on the glide path to full electrification. Manufacturers have several options to meet the new standards, and electric vehicles (EVs) will play a pivotal role in ensuring manufacturer compliance with these regulations. Under this final rule, battery electric and plug-in hybrid electric light-duty vehicles could make up 32 percent of all new vehicle sales in model year 2027, increasing to 69 percent by model year 2032. What are the EPA’s final vehicle emissions targets? How does the rule fare with the current pace of EV production? The goal of the EPA, in accordance with the Clean Air Act, is to dramatically reduce the emissions associated with cars and trucks on the road and reduce their impact on public health and the climate. However, the agency must ensure that these regulations are cost-effective, meaning that the benefits of minimizing vehicle emissions to consumers must outweigh the total costs. The auto industry, which contributes more than $1 trillion in sales to the economy and enables nearly 10 million jobs, will need to factor these requirements into their production plans to keep pace with the transition towards a lower-emissions future. The rules finalized last Wednesday pursue a “less aggressive pace” than the EPA’s initial proposal released in April, in part due to backlash from many automakers on the basis that the initial rules were too stringent. According to Audrey LaForest from Automotive News, the EPA “alleviated some of the pressure by giving automakers a longer runway to ramp up electric vehicle production and sales and by adding more flexibility for compliance by factoring in plug-in hybrids and other technologies.” Still, manufacturers will need to scale up production capacity of zero-emission vehicles considerably to meet the targets of this new rule. To put the new regulations into perspective, Tesla’s Fremont factory produced 560,000 vehicles in 2023. It would take 20 of these factories to produce enough EVs to meet the rule’s target in 2032, see the figure below.

|

|

|

What does the rule mean for the automotive industry? The combination of these new regulations with unprecedented federal support for EVs has significant implications for the automotive workforce. To date, over 150,000 jobs have been announced in EV and EV battery manufacturing since IIJA’s enactment in 2021. As automakers reposition to ensure compliance with new federal standards, investment in the U.S. EV manufacturing sector is poised to grow even more, spurring more jobs in local communities across the country. Looking ahead, the implementation of these regulations is set to accelerate EV adoption in the U.S. and position the U.S. auto industry as a key competitor on the global stage as we race toward an all-electric future. To understand how EVs are currently playing out in the automotive industry in terms of private-sector investment and job creation, visit the EV Jobs Hub. |