2023 was a stellar year for the electric vehicle (EV) market, and data from December affirmed the positive direction of where the EV market is headed.

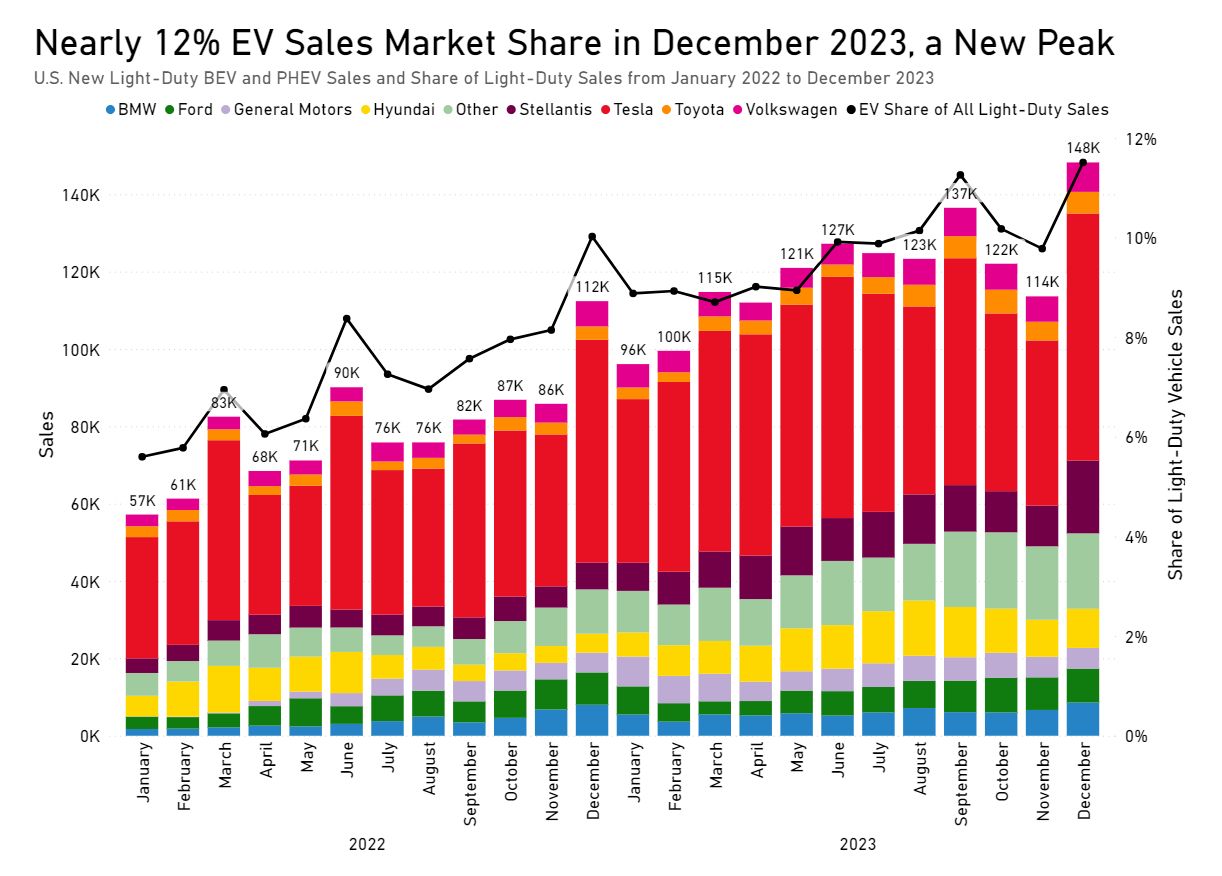

Nearly 12 percent of new light-duty vehicles sold in the United States in December 2023 were EVs, a market record. In total, the month saw over 148,000 light-duty EVs sold, up 32 percent from December 2022. Battery electric vehicles (BEVs) accounted for 77 percent of all EV sales in December.

Here are the trends we noticed:

To begin with some head-turning numbers, Stellantis closed out the year with nearly 19,000 sales in December. Stellantis sales have indicated remarkable growth. To put the company’s sales growth in perspective, the automaker’s sales have increased 171 percent from December 2022, which reported just under 7,000 sales. The automaker continues to spearhead the plug-in hybrid electric vehicle (PHEV) market, with the Grand Cherokee Plug In and Wrangler 4xe remaining the company’s top selling models.

From a strategy standpoint, Stellantis continues to make significant investments in its EV portfolio. Through negotiations with the United Auto Workers union, reports have indicated that the company is planning to build a $3.2 billion battery production facility in Belvidere, Illinois, with an expected launch date in 2028. And in more recent news, Stellantis became one of the latest automakers to adopt Tesla’s North American Charging Standard (NACS) in its upcoming EVs, a move consistent with ensuring standardized charging in the industry.

Next is Toyota. The automaker reported just under 6,000 sales in December 2023, with the RAV4 Prime accounting for nearly half of those sales (2,394 to be exact). Historically, the automaker has had a tumultuous relationship with EVs, but the company’s EV sales have indicated a subtle increase throughout last year. Moreover, the company has been in recent headlines again as it announces new commitments to advance EV production in the North American market. Earlier this month, Toyota announced a $1.3 billion investment at its flagship Kentucky facility, raising the plant’s total investment to $10 billion. The investment will support the assembly of a new three-row battery electric SUV among future electrification efforts.

Like Toyota, Ford sales bounced back after it experienced a dramatic dip in sales earlier in the year. In December, the company reported nearly 9,000 sales with the Mustang Mach-E capturing a new record with 4,545 sales. Ford – a prominent leader in the automotive industry – has been reportedly reevaluating its EV strategy, shifting its focus to smaller, inexpensive EVs according to Automotive News Europe. This development comes after the company cut production of its popular F-150 Lightning model and shaved down Mustang Mach-E costs.

Several other automakers closed out the year with record sales, including BMW, Volkswagen, and Mercedes-Benz. Explore the data here.