In a fresh new report produced in partnership with the International Council on Clean Transportation (ICCT), my colleagues Spencer Burget, Sophie Latham, and Matthew Vining assessed the state of play for heavy-duty (HD) zero-emission (ZEV) manufacturing in the United States.

Here were three key takeaways:

86 percent of HD vehicle manufacturing facilities in the U.S. are already producing ZEVs

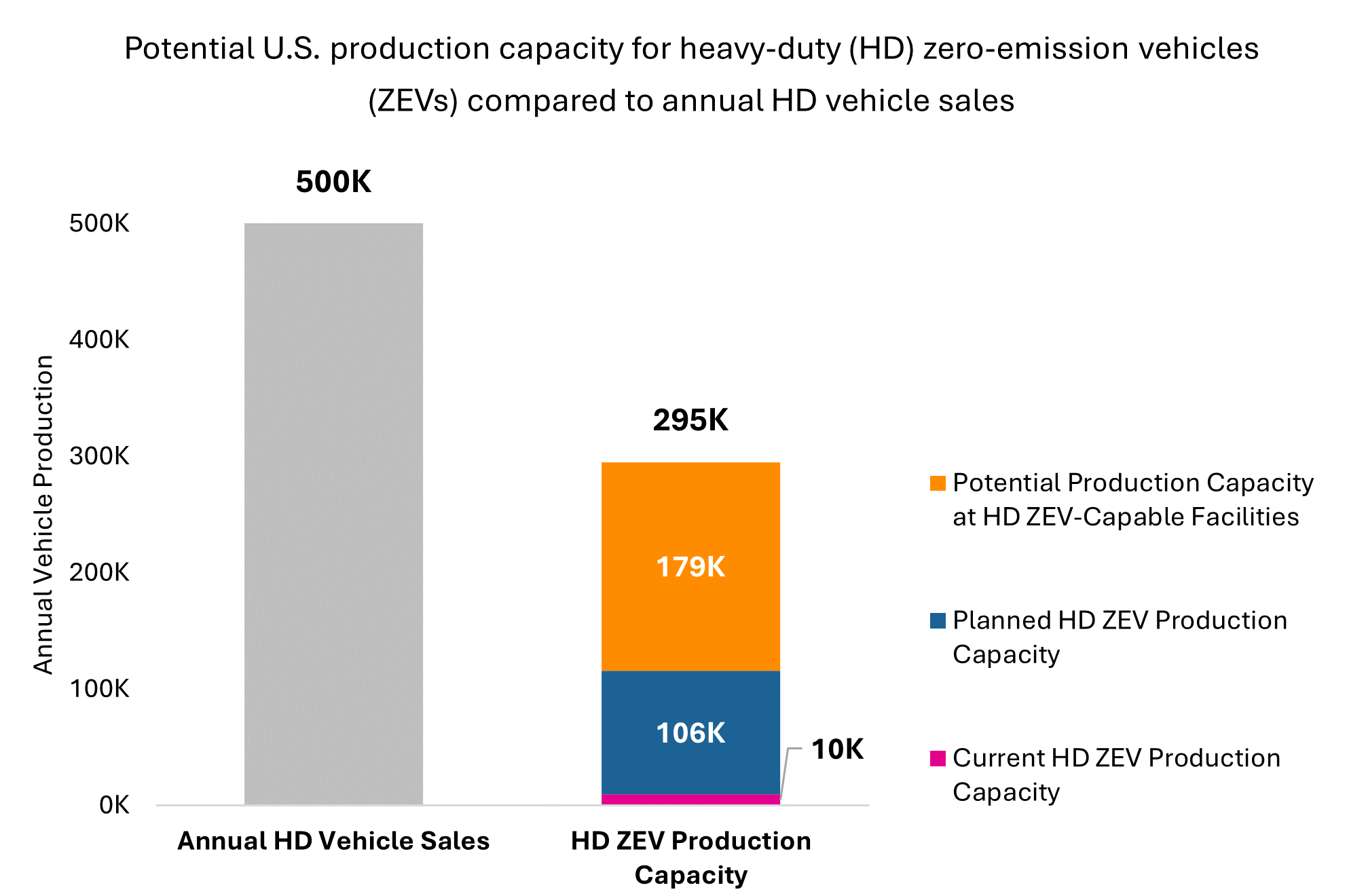

Atlas found that 37 out of 42 HD vehicle manufacturing facilities in the United States are already producing ZEVs. Collectively, these facilities are able to produce approximately 10,000 HD ZEVs per year, not including ten facilities where data was unavailable.

Lion Electric had the highest stated production capacity at 2,500 vehicles per year, followed by BYD with 1,500 vehicles per year.

HD vehicle manufacturers have announced plans to invest over $6.5 billion to increase production capacity by 106,000 vehicles per year

These commitments will bring the total production capacity to 116,000 ZEVs per year, 12 times the current capacity. This expansion includes plans to increase ZEV production capacity across eight existing facilities and to bring 11 new ZEV-producing facilities online.

Tesla leads the planned production ramp up, targeting an annual production capacity of 50,000 Tesla Semis at its Nevada gigafactory by the end of 2024. Tesla is followed by three EV-only startups: Lion Electric, Xos Trucks, and Workhorse who are each aiming to increase their production to over 10,000 units per year. In total, EV-only manufacturers account for 90 percent of publicly announced, planned ZEV capacity.

Existing HD vehicle manufacturers are well positioned to recalibrate their facilities to ramp up production of ZEVs

The top five HD vehicle manufacturers in the U.S., which account for over 85 percent of domestic production capacity, have all announced plans to recalibrate their existing facilities to produce HD ZEVs:

-

Ford Motor Company is investing more than $50 billion in the transition to EVs including $1.5 billion to launch an all-new commercial EV at its Ohio Assembly Plant by mid-decade.

-

Paccar has added ZEV production lines at two of its three production facilities in the U.S. with an estimated collective capacity of over 40,000 trucks.

-

Daimler Truck launched series production of its flagship Freightliner eCascadia and eM2 at its plant in Portland, Oregon.

-

Volvo Group’s Volvo Trucks upgraded its New River Valley Plant to produce electric trucks alongside diesel vehicles.

-

Navistar (TRATON Group) opened a new manufacturing facility in San Antonio Texas with an annual capacity of 13,000 trucks specifically dedicated to producing diesel and electric trucks side by side.

The flexibility of these recalibrated facilities enables manufacturers to easily scale ZEV production to meet growing demand.

In total, if all the production capacity at facilities capable of producing both ICE and ZEV heavy-duty vehicles was dedicated exclusively to ZEVs, existing manufacturers could produce more than 175,000 HD ZEVs per year. Combined with current and planned ZEV production capacity, this conversion could put U.S. production capacity at over 295,000 HD ZEVs per year, representing 59 percent of annual HD vehicles sales.

Read the full report here.