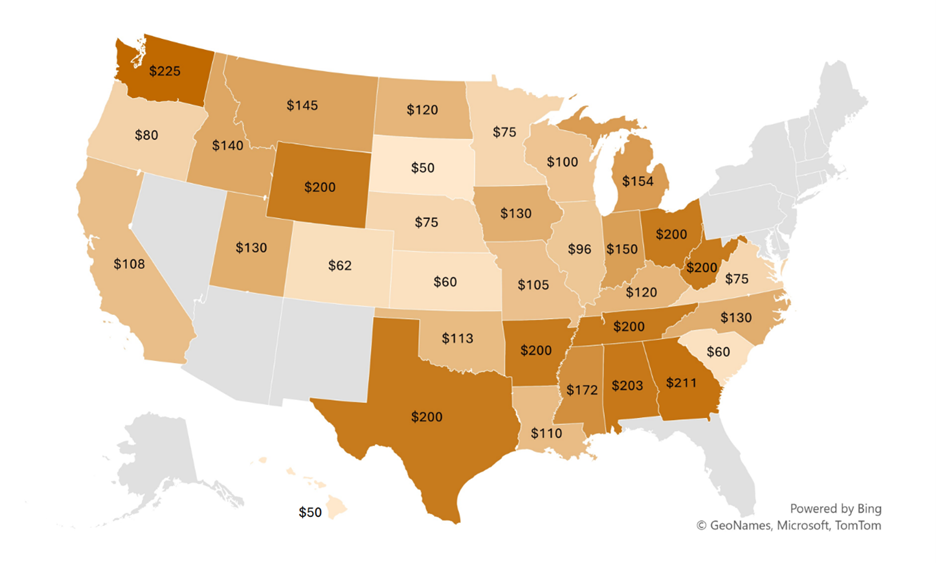

Average battery electric vehicle fees by state (2023)

This digest was written by Nate Graham, Policy Intern at Atlas Public Policy.

Thirty-four states have now passed additional annual registration fees for electric vehicles, largely to compensate for the gas taxes they do not pay. True, motor-fuel taxes have failed to keep up with road spending in recent decades, having historically provided most federal road funding (and in recent years, around a third of state road funding). However, a new Atlas report explains that EVs are not the problem, and there are better solutions than EV fees. Here are three key takeaways from the report:

-

Roads have been underfunded for years due to inflation, stagnant gas tax rates, increasing fuel economy, and slow growth in vehicle-miles traveled (VMT). The federal gas tax rate hasn’t risen in 30 years. Between 2003 and 2021, as the average state gas tax rate rose about 40 percent, the cost of building roads more than doubled. Meanwhile, from 2005-2020, the fuel economy of light-duty vehicles increased by nearly a third, and VMT growth slowed substantially. Despite rapid sales growth, in 2021, battery electric vehicles (BEVs) still accounted for just 0.5 percent of light-duty vehicle registrations and less than one percent of the gap between federal motor-fuel revenues and highway spending.

-

Many states charge EV fees that could be considered “unfair.” There are different definitions of what constitutes a “fair” EV fee. These include the average annual gas tax revenue paid by a) the average vehicle on the road, b) the average new vehicle (a much lower figure because of increasing fuel economy), and c) a hypothetical gasoline vehicle with 117 MPG, the energy-basis MPG-equivalent of the average BEV. Depending on one’s definition of fairness, at least eight states, and as many as all 34 states with fees, charge BEVs more than the fair level. This can discourage potential EV buyers at a critical juncture for decarbonizing our transportation sector.