Source: ICCT

Last week, we highlighted the anticipated drop in battery prices that continues to make EVs more competitive with conventional vehicles. Analysts at Morgan Stanley predict that falling battery prices are one factor in addition to a surge new models that will lead to a 50 percent increase in global EV sales in 2021. An expanding global EV market will also increase demand for minerals needed to manufacture batteries. A new report from the International Council on Clean Transportation (ICCT) quantifies the raw materials needed to support the growing global EV sector and the potential to advance battery recycling practices.

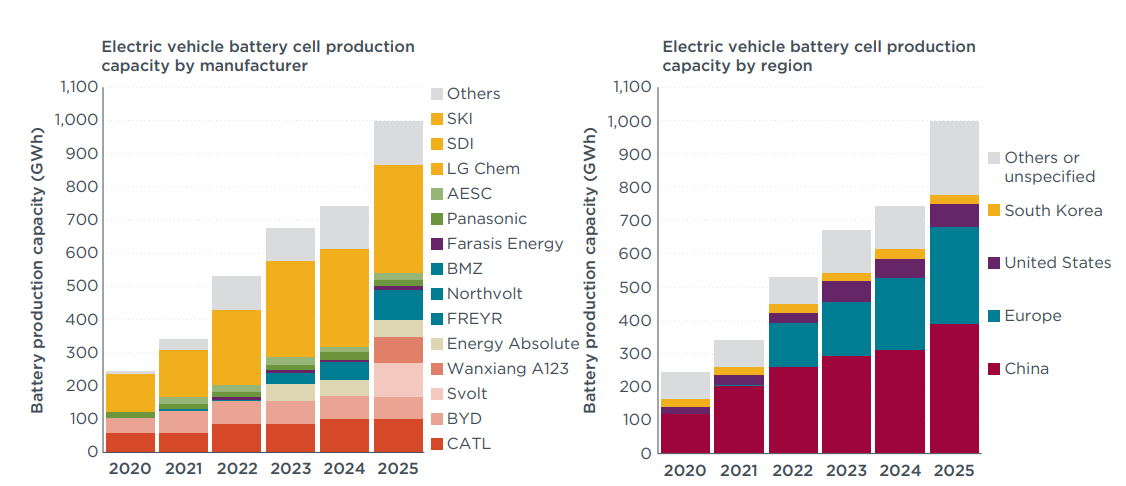

The report finds that an estimated global investment of $680 billion in EV manufacturing and battery procurement would require additional investment in mining and refining activities upstream to avoid supply crunches through 2025. While ICCT claims that further investment is needed, they find that the reserves of essential materials for batteries are more than sufficient to meet demand. Notably, the projected growth in passenger EVs by 2035 is expected to tap only eight to 14 percent of proven global lithium, nickel, and cobalt reserves. The report also highlights innovations in EV batteries that could reduce the per kilowatt-hour demand for Cobalt, a mineral linked to conflict zones and exploitation of workers, by 75 percent. Daimler is one of several automakers that have taken the lead in addressed this issue throughout their supply chains, committing in November to sourcing minerals from certified mines with stronger worker protections.

There are more ways EV stakeholders can minimize their mineral footprints. According to the ICCT, policy commitments pushing EV sales in China, Europe, and select states and provinces in the United States and Canada are key factors driving growth in the EV market. These commitments are also a potential source of battery supply shortages within the most advanced EV markets. In these areas, manufacturers and other stakeholders have an opportunity to scale up battery recycling to both reduce the mining footprint of EVs and ensure reliable supplies. The ICCT finds that recycling and second-life battery use for applications like energy storage could reduce the raw material demand by 20 percent through 2040 while still meeting EV market growth. These developments could reduce the environmental externalities associated with increasing mining that have been covered in recent media stories.

Reduction in mining demand is possible even without anticipated advancements in battery technology being pursued by automakers and manufacturers around the world. Toyota has promised a potential solid state battery prototype as early as 2021 in an announcement on December 10th. By advancing from the existing lithium-ion chemistry, the automaker claims their new batteries could offer vehicle range up to 500 kilometers and a charge time of ten minutes. Toyota isn’t the only company looking to new battery chemistries to achieve EV success and it faces competition from Nissan and other automakers. Tech startups are also active in the race to solid state battery marketization. In one of their first major public announcements on December 8th, Volkswagen-backed QuantumScape announced they will enter full production in 2024. On the Lithium-ion front, Tesla and GM have both announced battery innovations in the second half of 2020 that are expected to produce longer ranges and faster recharge times for upcoming EVs. You can track the global private investment in EV and battery development, now totaling more than $450 billion, on the Global Private Investment Dashboard.