Despite continued growth, challenges surrounding charging accessibilitycontinues to hold significant influence over consumer decisions when considering purchasing an EV.

Range anxiety is especially prevalent in the growing used EV market. States like Oregon are actively seeking to accelerate the used EV market with programs like the Charge Ahead rebates for low-income drivers looking to buy either new or used EVs. While these programs help bring down the cost of EVs and allow drivers to maximize savings potential, used EVs typically have less range than newer models. This leaves some drivers more dependent on public charging infrastructure.

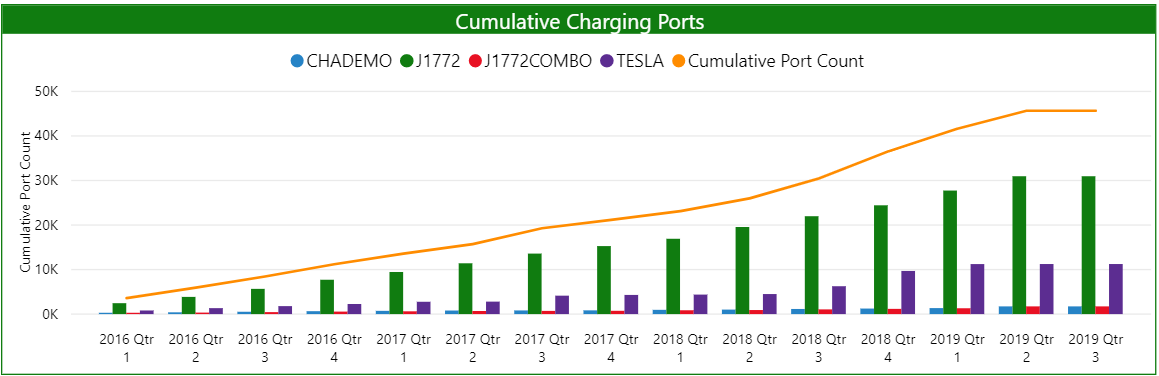

Public programs, utility engagement, and private investment are accelerating public charging investment. Cumulative charging ports in the United States increased by 40 percent between the first quarters of 2018 and 2019 according to the EV Hub EV Charging Deployment Dashboard. This is up from a 26 percent increase between 2017 and 2018. As of June 2019, there were 68,241 charging ports recorded throughout the country. 84 percent of these are Level 2 stations and 30 percent of all charging stations are located in California.

Utility investment in charging infrastructure has more than doubled nationwide since 2017. Approved utility investments worth more than $1 billion support more than 47,000 charging stations. Many of these charging stations have not been built, and pending investments worth more than $1.5 billion could lead to the deployment of more than 115,000 additional charging stations. Utility investment is essential to reducing the charging gap, where 88 of 100 largest metropolitan areas in the United States don’t have enough charging stations to satisfy growing EV demand by 2025 according to the International Council on Clean Transportation (ICCT). While utility investment to date is significant, fewer than 20,000 of stations covered in approved programs are designated as public.

Public and private investment are critical to public charging. To date, more than $465 million in public funding at the state and local level, $400 million in federal grants, and $2.6 billion in private investment has been committed to expanding the national charging network. Public agencies working together with private sector entities will likely see the largest charging network expansion. Electrify America, which accounts for nearly $2 billion of the total private investment, works directly with agencies like the California Air Resources Board to ensure that their investments reach priority areas and support statewide transportation electrification goals.

Deployment of charging across the United States is positioned to accelerate. Public investment will expand as states continue awarding VW Settlement money. Only $25 million of the $270 million committed for charging infrastructure has been awarded.

Combined with increasing standardization in the private sector, where Electrify America and ChargePoint customers can now use the two charging services interchangeably, charging is likely to become both more accessible and convenient for drivers. The EV Hub will continue to track progress across the transportation electrification industry as we prepare to release our quarterly summary for the second quarter later this month.