Source: Q4 Quarterly Review

Last week, we published our Q4 Quarterly Review, which summarizes key electric vehicle (EV) policy and market developments in October, November, and December of 2023. As a reminder, we publish slide decks summarizing developments for each quarter here. Below are the big takeaways from Q4 2023.

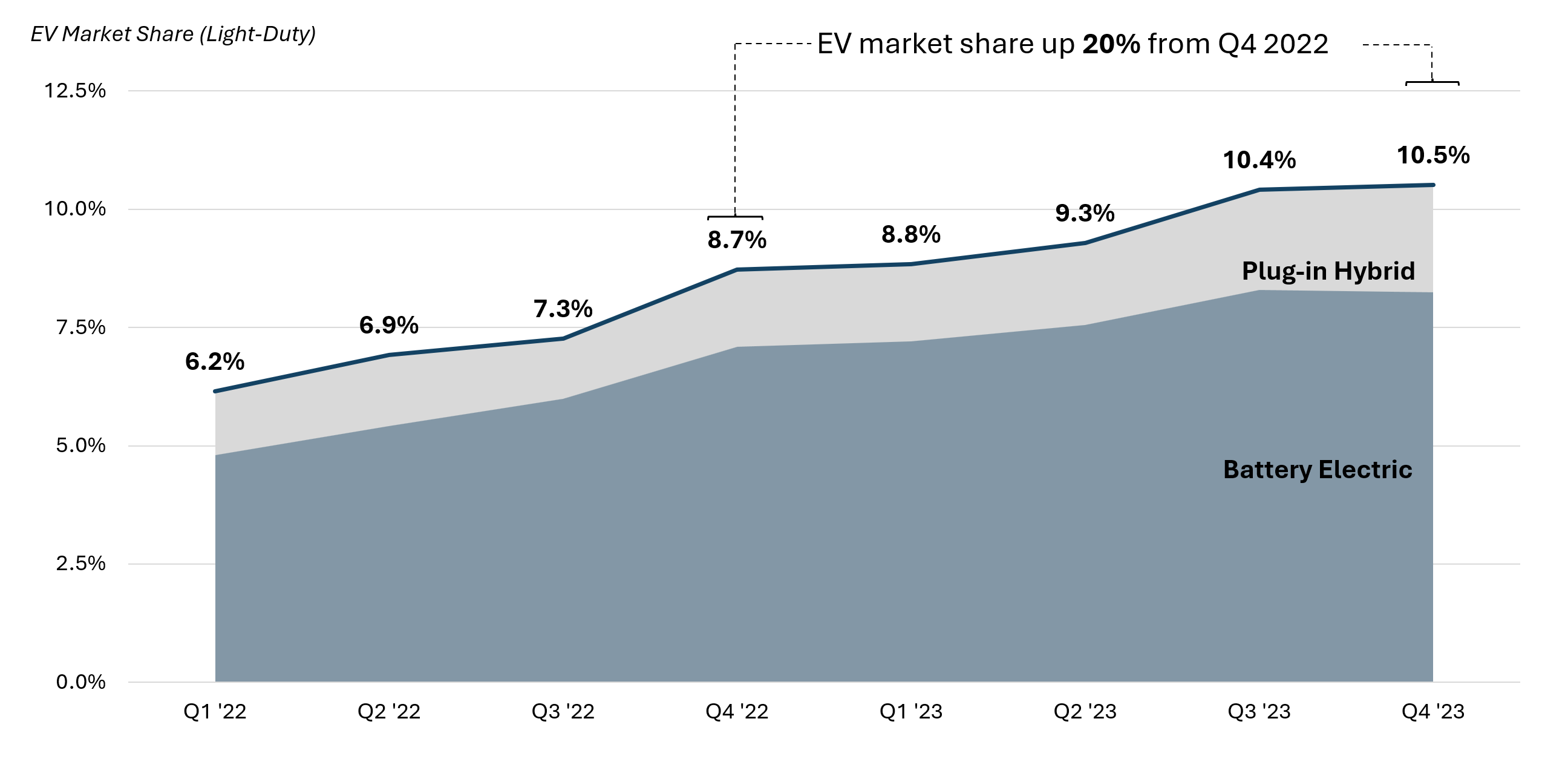

First, nearly 384,000 light-duty EVs were sold in the United States during Q4, representing 10.5 percent of the overall light-duty vehicle market. In 2023, nearly 1.44 million light-duty EVs were sold in the U.S., representing 9.8 percent of all new light-duty vehicles sold. According to the data, EV sales continue to grow at record levels, despite recent headlines telling a different story.

Stellantis had a record quarter with nearly 40,000 light-duty EV sales, unseating Hyundai as the second highest seller next to Tesla. Stellantis continues to spearhead the PHEV market with the Grand Cherokee plug-in and Wrangler 4xe dominating the automaker’s sales.

Moreover, Telsa sold nearly 153,000 light-duty EVs in Q4 – 40 percent of the quarter’s total light-duty EV sales. Tesla’s market share continued to decline, despite having a record sales month in December (63,000 sales). Several other automakers reported quarterly records, including BMW and Volkswagen who each reported 21,000 light duty EV sales.

Light-duty EV market share on the state level continues to accelerate. During Q4, 17 states surpassed a 10 percent EV market share, compared to just 13 states from the previous quarter. Per usual, California leads all states with a 25 percent market share, followed by the District of Columbia and Washington state at 21 and 20 percent, respectively.

EV sales data can be explored on our Automakers Dashboard.

Second, companies announced nearly $16 billion in new investments to manufacture or recycle EV batteries in the U.S during Q4. Relatedly, nearly $100 billion for domestic EV and EV battery manufacturing has been announced since the passage of the Inflation Reduction Act, speaking to the influence of supportive climate policy. Some notable investment developments from Q4 include:

-

An additional $8 billion investment from Toyota to manufacture batteries in Liberty, North Carolina, creating 3,000 jobs and bringing the total investment in the site to nearly $14 billion.

-

$3.2 billion from Stellantis to produce batteries in Belvidere, Illinois, expected to begin operations in 2028.

-

$810K from Envision AESC to expand an existing battery production plant in Florence County, South Carolina, slated to create 450 new jobs by 2028.

As a reminder, the EV Jobs Hub visualizes where EV manufacturing investments are being made and the corresponding creation of jobs in the U.S.

Finally, nearly $523 million in utility investments were approved by regulatory commissions, marking it a significant quarter for utility investments after a sleepy year. In particular, the New York Public Service Commission, as part of its midpoint review for both the Make-Ready and Medium and Heavy-Duty Fleet Make Ready Programs in the state, gave the stamp of approval for an additional $523 million in funding, bringing the total funding amount for those programs to a $1.14 billion across the Joint Utilities of New York. Of this increased funding, nearly $133 million is earmarked for underserved communities.

View the Q4 Quarterly Review here.