Source: EV Hub

|

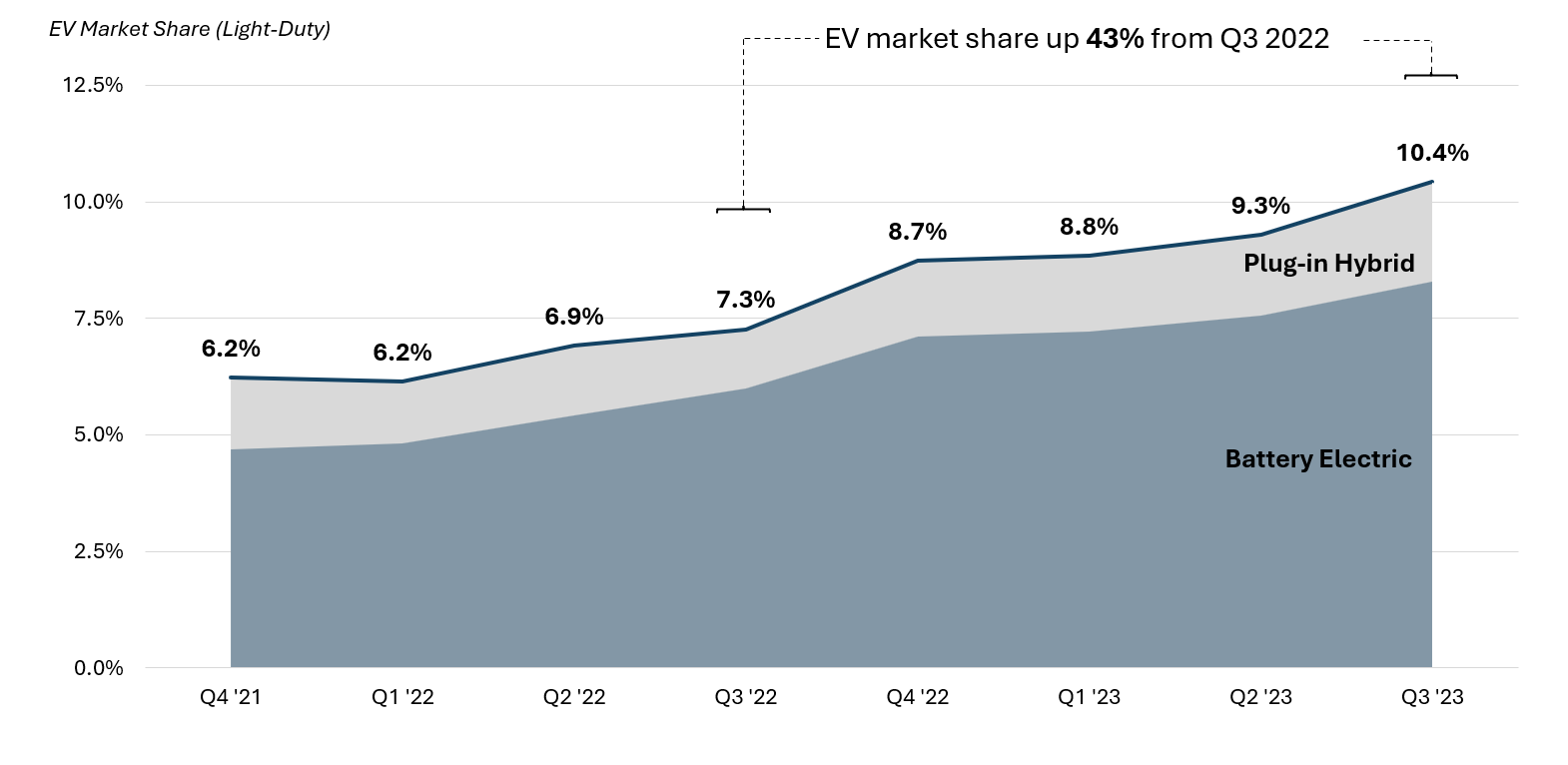

Today, we published our Q3 Quarterly Review, which packages up key electric vehicle (EV) policy and market developments in July, August, and September of this year. As a reminder, you can view the slide decks for each quarterly review here. Below are three key EV developments from Q3: First, U.S. EV market share in Q3 reaches 10.4 percent, up 43 percent from last year. To put that into perspective, that means that for every ten light-duty vehicles sold in the U.S., one was an EV. During Q3, nearly 385,000 light-duty EVs were sold, up 65 percent from Q3 2022 which accumulated nearly 234,000 EV sales. Even more notable, over a million EVs were sold through the end of Q3 this year, an unprecedented record. Tesla wrapped up Q3 with nearly 163,000 sales, an eight percent decrease from Q2 which saw nearly 176,000 sales. Tesla encountered two consecutive months of declining EV sales in July and August, but the automaker finished the quarter strong with its second strongest month in terms of sales in September with nearly 59,000 sales. Furthermore, Hyundai is cementing its position second to Tesla in the EV market with its strongest quarter yet. The automaker ended Q3 with over 40,000 sales, and the popular Ioniq 5 represented a quarter of those sales. Hyundai sales have increased a colossal 150 percent from Q3 2022. Furthermore, 13 states have exceeded a 10 percent EV market share in Q3. California leads all states with 27 percent, followed by Washington state and the District of Columbia at 20 and 19 percent, respectively. Additionally, since Q2, three states’ EV market share surpassed 10 percent, including Hawaii, Connecticut, and Vermont. Figure 2 States with an EV market share above 10 percent. |

|

|

Next, nearly $600 million in public funding was issued by states in Q3, the highest on record for state funding. The bulk of this funding comes from California where the state issued nearly $450 million for medium- and heavy-duty electrification through its Port Infrastructure program. Additionally, six states awarded $84 million of NEVI funding in Q3 2023:

Note: Hawaii awarded funding through a direct contract instead of issuing through a grant application. Finally, nearly 2,500 public Direct Current Fast Chargers (DCFC) were installed during Q3, a 48 percent increase from last year. With these new installations, the U.S. surpassed 35,000 public DCFC ports, up from fewer than 27,500 at the start of the year. Tesla accounted for two-thirds of the ports added in Q3, followed by eVgo and ChargePoint. The chart below shows DCFC installations by network in Q3 for the ten networks who added the most stations. Figure 3: Public DCFC Ports Opened in Q3 2023 By Network (Top 10) |

|

|

See more key insights from the entire Q3 Quarterly Review here. |