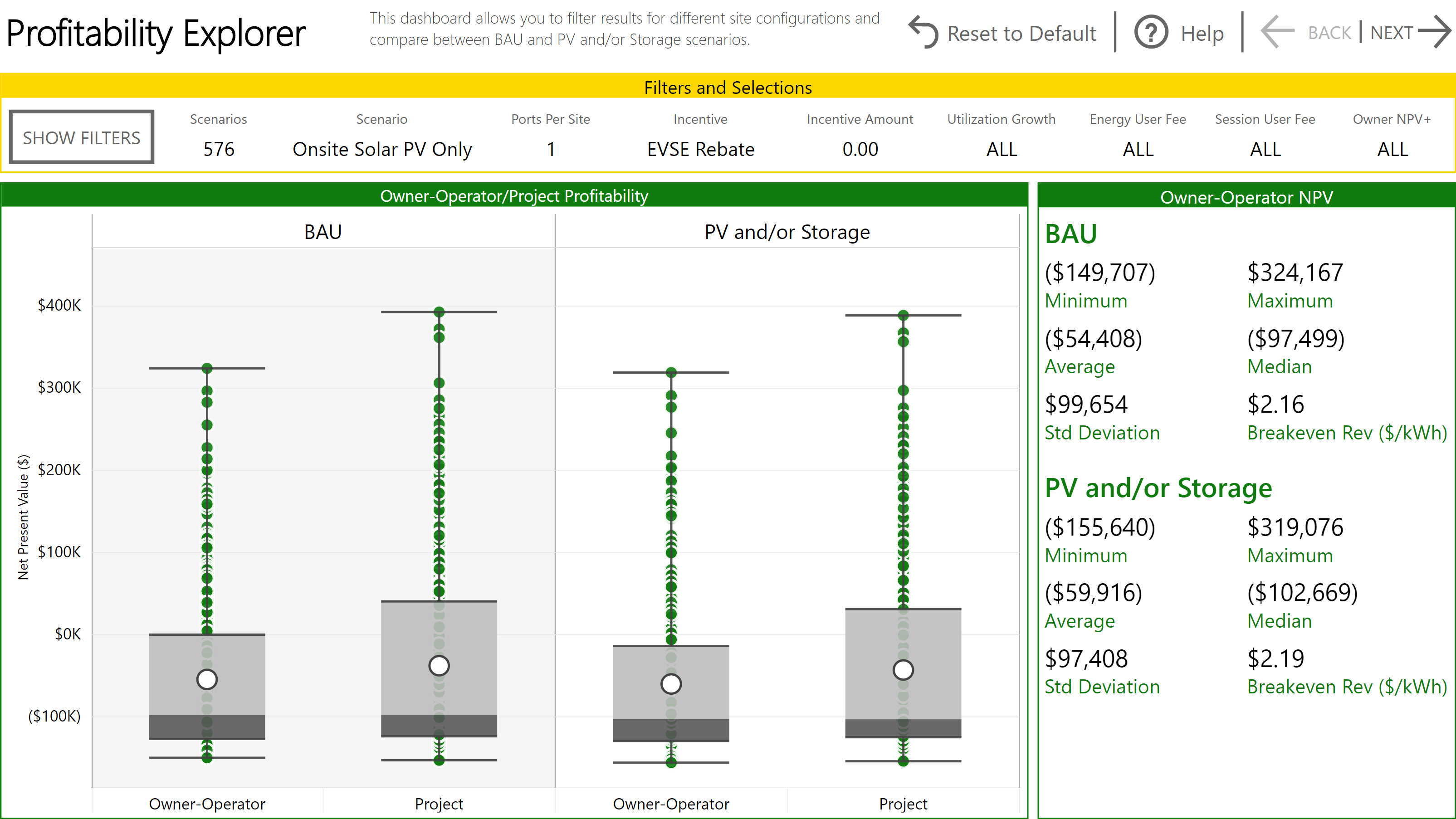

Extreme fast charging complexes can achieve profitability in less than five years, according to an analysis by Atlas Public Policy. The analysis used the EV Charging Financial Analysis Tool to assess the business case for 1-plug, 4-plug, and 20-plug extreme fast charging complexes. The complexes either relied on in the electrical grid, referred to as the BAU or business-as-usual case, or had onsite solar photovoltaic (PV) generation and/or energy storage. In general, we found systems that did not have onsite solar photovoltaic (PV) generation and/or energy storage had better financial performance than those systems with the technology, due to the higher capital costs that could not be fully recovered. Also, fast charging sites with one or four plugs can achieve profitability, generally, albeit at a lower magnitude compared to sites with 20 charging plugs. Due to higher expected demand, 20-plug sites can achieve a much higher profit.