Correction: An earlier version of this data story stated that there is $150 billion in IIJA and IRA eligible for EVs. While this figure is accurate if loan programs and tax credits are included, the number has been revised to exclude loan programs and tax credits, providing a more appropriate comparison with the funding tracked in the data story.

Introduction

In November 2021 President Biden signed the Infrastructure Investment and Jobs Act (IIJA), also known as the Bipartisan Infrastructure Law (BIL), authorizing an estimated $1.2 trillion investment in U.S. infrastructure, including at least $7.5 billion dedicated to supporting electric vehicle (EV) adoption through dedicated funding for vehicles and charging infrastructure. The act includes an additional $32.5 billion eligible to support EVs, plus $10.5 billion for grid upgrades and battery development. Nine months later, in August 2022, President Biden signed the Inflation Reduction Act (IRA), creating an additional $369 billion in climate investments including $47 billion eligible to support EVs (not including tax credits or loan programs).1,2

This data story seeks to put the unprecedented scale of these federal EV investments in historical context. The federal government has been investing in the research and development, manufacturing, and deployment of EVs since as early as 2008. Atlas reviewed publicly available program documents and funding announcements to see what can be learned about federal investments in EVs to date, and what it means for the implementation of IIJA and IRA.

Overview

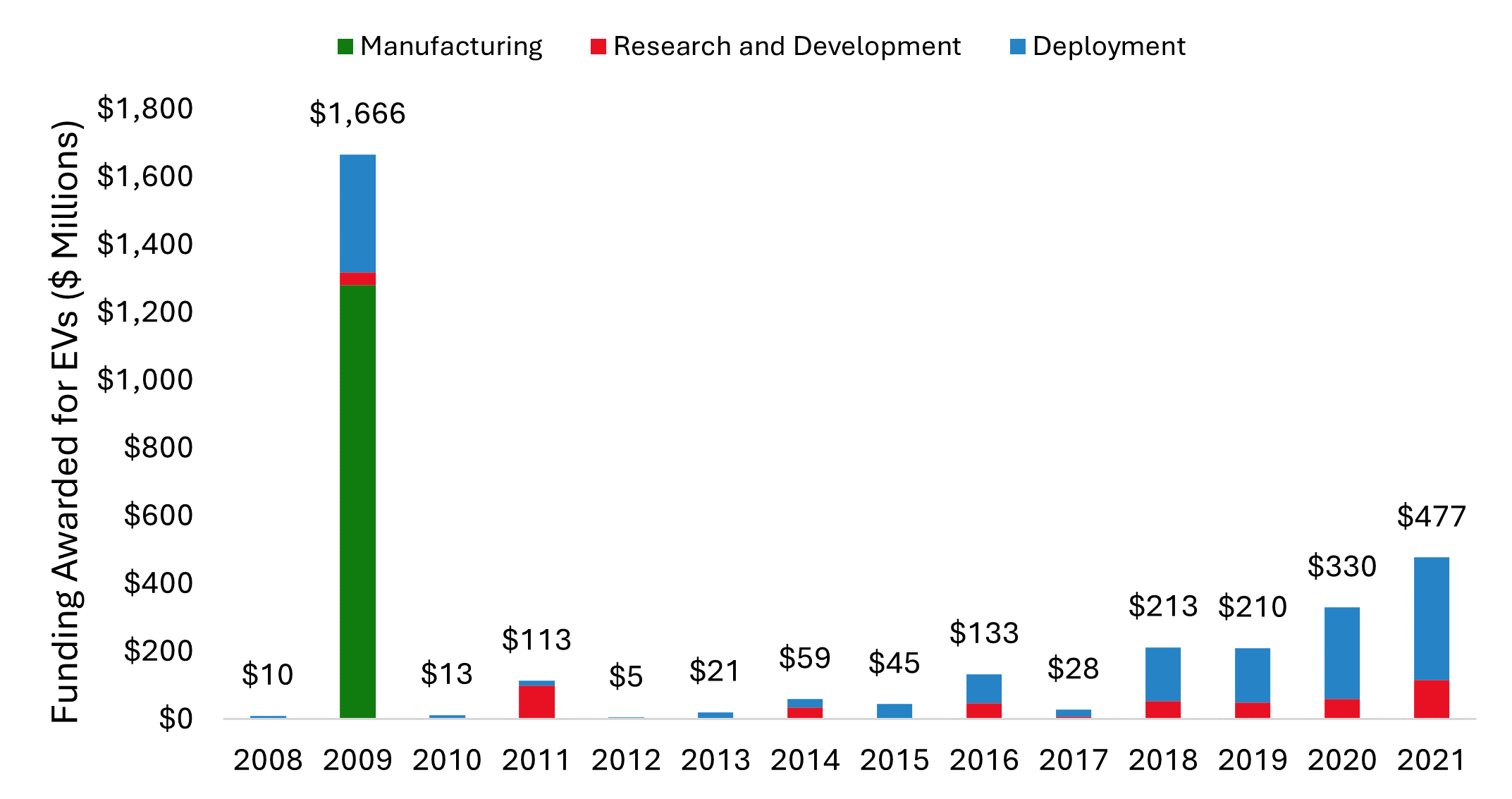

In total, Atlas tracked $3.3 billion awarded by the United Sates government for EVs across 16 programs prior to IIJA and IRA. The American Recovery and Reinvestment Act of 2009 (ARRA) accounts for more than half of that investment: more than $1.6 billion was awarded through a) the Electric Drive Vehicle Battery and Component Manufacturing Initiative, which supported the construction of U.S.-based manufacturing plants for batteries and electric drive components, and b) the Transportation Electrification initiative, which provided grants for vehicles and charging stations. Nearly 80 percent of this 2009 ARRA funding went toward supporting manufacturing or research and development, compared to only 20 percent that supported deployment of EVs or chargers. Since then, federal funding has shifted towards deployment, primarily through grants for electric transit buses from the Federal Transit Administration. Figure 1 shows federal funding for EVs annually, and shows this trend away from funding for manufacturing and toward funding for EV and charger deployment.

Figure 1: United States Federal Funding Awarded for EVs prior to IIJA and IRA by Funding Type and Award Year

Source: EV Hub

Most federal funding for EVs has come from programs that are primarily dedicated to transportation electrification. However, there are a number of broader transportation infrastructure programs that fund EVs as well as vehicles of other fuel types. Historically, only a small portion of funding awarded under these programs has gone towards EVs, and overall, only 20 percent of all federal funding for which EVs were eligible went to EVs. Table 1 lists federal programs that could fund EVs and shows the percent of funding that went to EVs. Each of these programs is discussed in depth below.

In total, the $100 billion for which EVs are eligible in IIJA and IRA represents nearly 30 times the total EV funding awarded by the U.S. government to date.

Table 1: U.S. Federal Programs for Which EVs And EV Infrastructure Have Been Eligible Prior to IIJA and IRA

|

Program |

EV Funding* ($ M) |

Total Funding ($ M) |

Percent of Program Funding Allocated to EVs |

|

American Recovery and Reinvestment Act |

$1,666 |

$2,563 |

65% |

|

Low- or No-Emission (Low-No) Grant program |

$610 |

$666 |

92% |

|

Vehicle Technologies Office Funding |

$515 |

$1,076 |

48% |

|

Buses and Bus Facilities Program |

$260 |

$2,138 |

12% |

|

Congestion Mitigation and Air Quality Improvement (CMAQ) – Alternative Fuel and Vehicles |

$80 |

$259 |

31% |

|

Diesel Emissions Reduction Act |

$76 |

$739 |

10% |

|

RAISE/BUILD/TIGER3 |

$61 |

$8,926 |

1% |

|

Airport Zero Emission Vehicle and Infrastructure Pilot Program Grants |

$48 |

$48 |

100% |

|

Grand Total Prior to IIJA and IRA |

$3,316 |

$16,413 |

20% |

* EV funding includes funding for electric vehicles, EV charging infrastructure, and EV batteries.

Source: EV Hub

American Recovery and Reinvestment Act (ARRA)

The federal government passed the $787 billion American Recovery and Reinvestment Act (ARRA) in response to the Great Recession in 2009. The act invested broadly in infrastructure, housing, education, and research and development. Atlas specifically analyzed $2.5 billion administered through the Vehicles Technology Office across four programs:

- Transportation Electrification

- Electric Drive Vehicle Battery and Component Manufacturing Initiative

- Advanced Technology Powertrains for Light-Duty Vehicles

- SuperTruck

Awards made under ARRA’s Transportation Electrification program helped pave the way for transportation electrification. Grants to ECOtality (now Blink) and Coulomb Technologies (now ChargePoint) helped develop a nationwide network of more than 14,000 Level 2 and 300 DC fast chargers in conjunction with the deployment of 2,600 Chevrolet Volts and 5,700 Nissan Leafs.4 Today, ChargePoint and Blink account for nearly half of the publicly accessible Level 2 charging ports in the U.S. and nearly 2,000 DC fast charging ports. Chevrolet’s plug-in hybrid Volt and Nissan’s fully electric Leaf are the two best-selling non-Tesla EVs of all time with 330,000 units sold to date.

Low or No Emission Vehicle Program

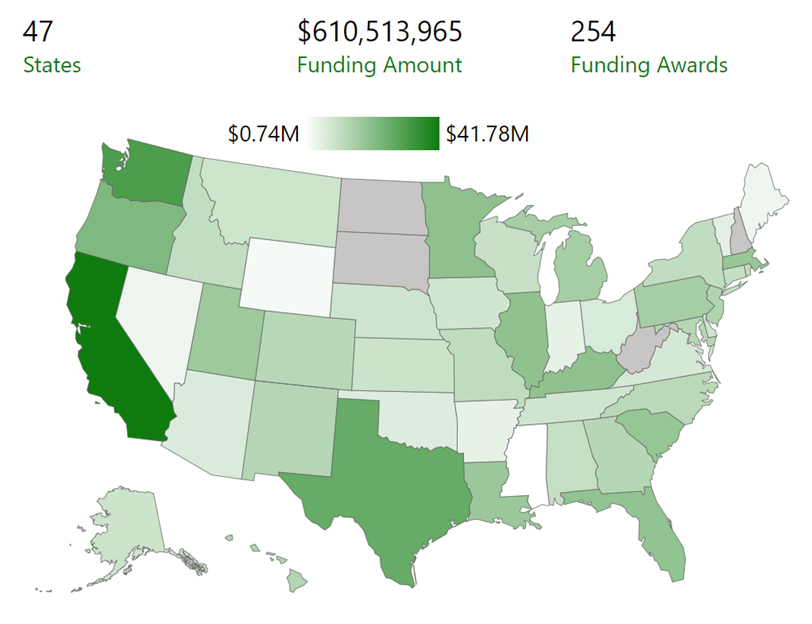

The Federal Transit Administration (FTA)’s Low or No Emissions Vehicle Program (‘Low No’) has awarded $610 million to date for electric buses, representing 92 percent of the total awards made under the program. Low No has funded electric buses in 47 out of 50 states, enabling transit electrification even in states without local policy support for electric vehicles. In Mississippi for example, a Low No grant to Coast Transit Authority for the purchase of electric transit buses represents the only public funding for electric vehicles in the state to date. While California, a state that has historically been a leader in EV investment, has received the most funding, states that are less supportive of EVs such as Texas, Kentucky, and South Carolina, are also well represented with $66 million in funding awards between them (Figure 2).

Figure 2: Funding Awarded for Electric Transit Buses under the ‘Low No’ Program by State

Source: EV Hub

IIJA increases Low No funding by nearly ten times, with $5.5 billion available from FY 2022 to FY 2026. IIJA also adds two new requirements. First, a minimum of 25 percent of Low No funding must go towards non-zero emission vehicles. To date, only eight percent of awards have gone to non-zero emission vehicles, so IIJA will provide a significant boost to other qualified low emission buses like those fueled by natural gas. In addition, transit agencies applying for a zero-emissions project must submit a zero-emission transition plan and spend at least five percent of their award on workforce development and training.

On August 16, 2022, the FTA announced the Fiscal Year 2022 Low No awards. More than $830 million was awarded for electric buses, representing 75 percent of total funds awarded.

Buses and Bus Facilities

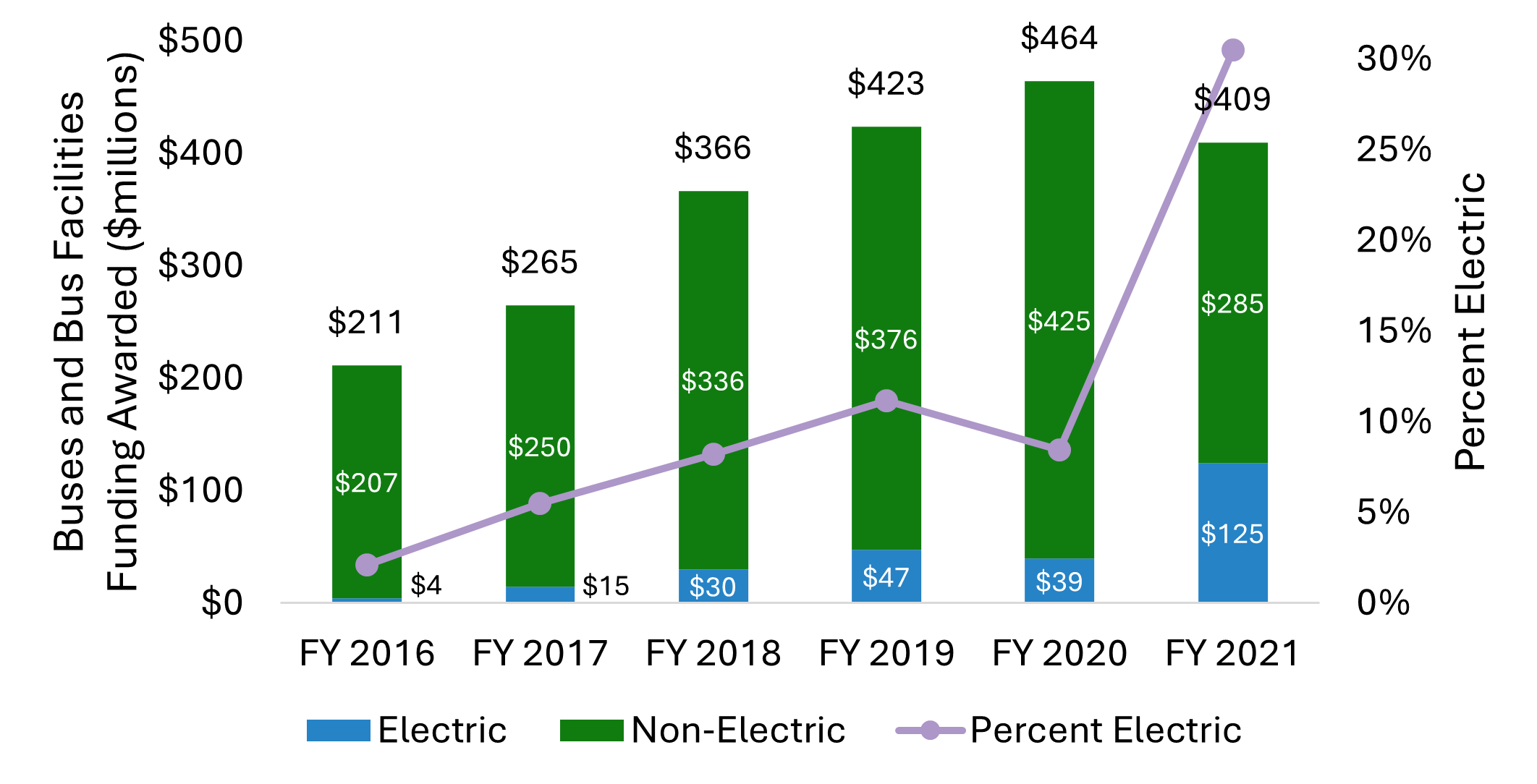

The Buses and Bus Facilities program compliments the ‘Low No’ program by funding the construction and rehabilitation of transit bus facilities. To date, 12 percent of funding awarded under this program has gone towards preparing or constructing facilities to house electric buses. However, this portion is on the rise, with electric projects representing 30 percent of awards in FY 2021. Figure 4 shows the rise of electric Buses and Bus Facilities funding over time.

Figure 3: Buses and Bus Facilities Funding Awarded by Fuel Type and Year

Source: EV Hub

IIJA includes $2 billion for competitive grants and $3.2 billion for formula grants under the Buses and Bus Facilities program. Like the Low No program, transit agencies applying for a zero-emissions project must submit a zero-emission transition plan and spend at least five percent of their award on workforce development and training.

On August 16, 2022, the FTA announced the Fiscal Year 2022 Buses and Bus Facilities awards. More than $350 million was awarded for electric buses, representing 65 percent of total funds awarded.

Vehicle Technologies Office

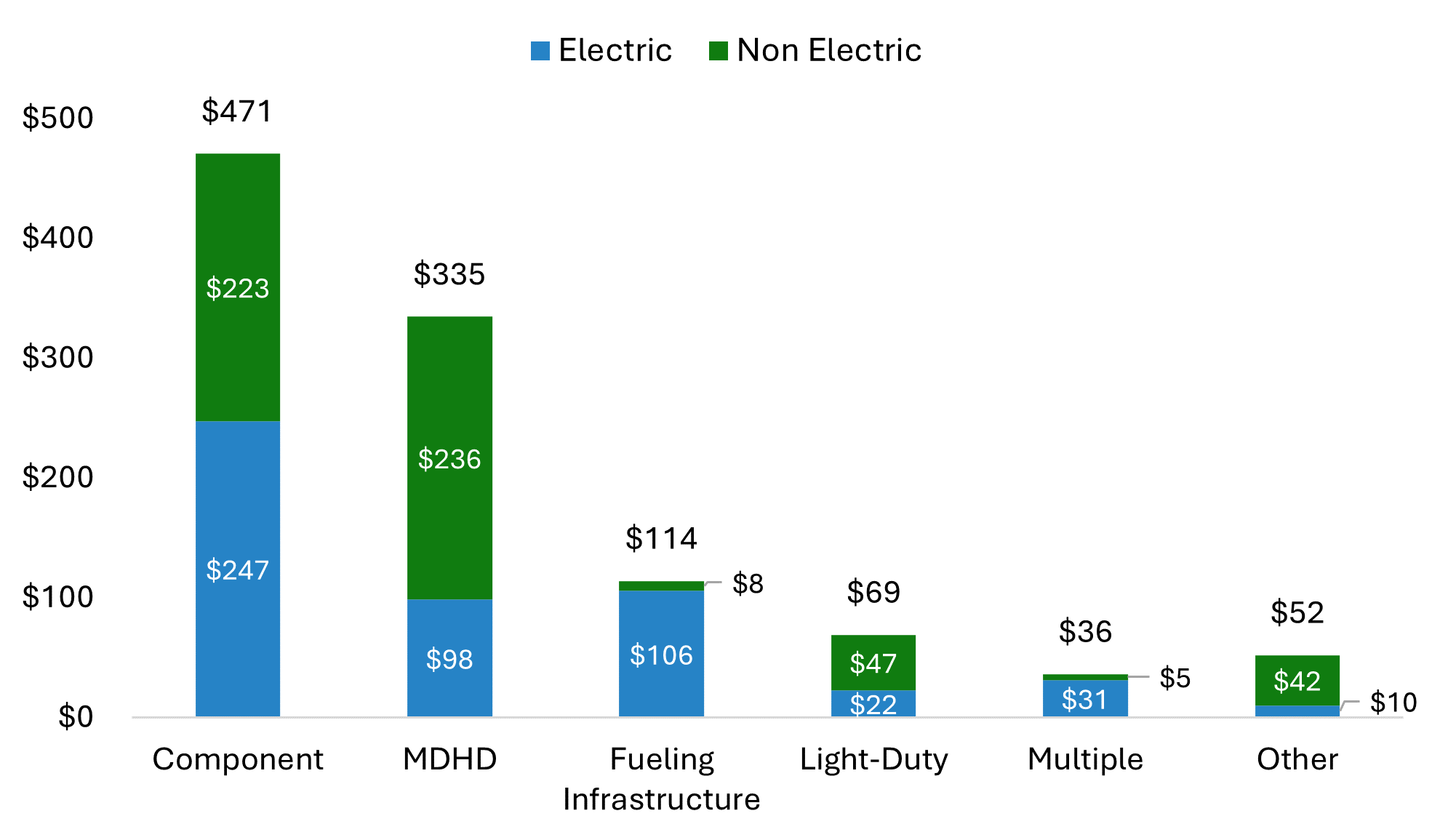

Through a suite of eight distinct programs, the U.S. Department of Energy’s Vehicles Technology Office (VTO) has awarded more than $500 million for the research and development of EV technologies such as battery materials, electric powertrains, and charging stations. Funding for EVs represents nearly half of all funding awarded by VTO to date. This funding amount does not include the ARRA funding administered by VTO and discussed in the ARRA section.

Research into cheaper and more efficient battery technology has led the way, accounting for 35 percent of electric awards. Batteries are followed by research and development of charging stations and electric medium- and heavy-duty (MDHD) vehicles each at 20 percent. Figure 4 shows the breakdown of VTO funding by project type.

Figure 4: Vehicles Technology Office Funding to Date by Project Type and Fuel Type

Source: EV Hub

Congestion Mitigation and Air Quality Improvement Program (CMAQ)

The Congestion Mitigation and Air Quality Improvement Program (CMAQ) funds states and metropolitan planning organizations to reduce air emissions through transportation projects in air quality non-attainment and maintenance areas. The program funds a broad range of project categories ranging from alternative fuels vehicles, to bicycle and pedestrian facilities, to travel demand management. CMAQ has funded more than $42.2 billion to date. For this data story Atlas exclusively analyzed Alternative Fuels and Vehicles projects.

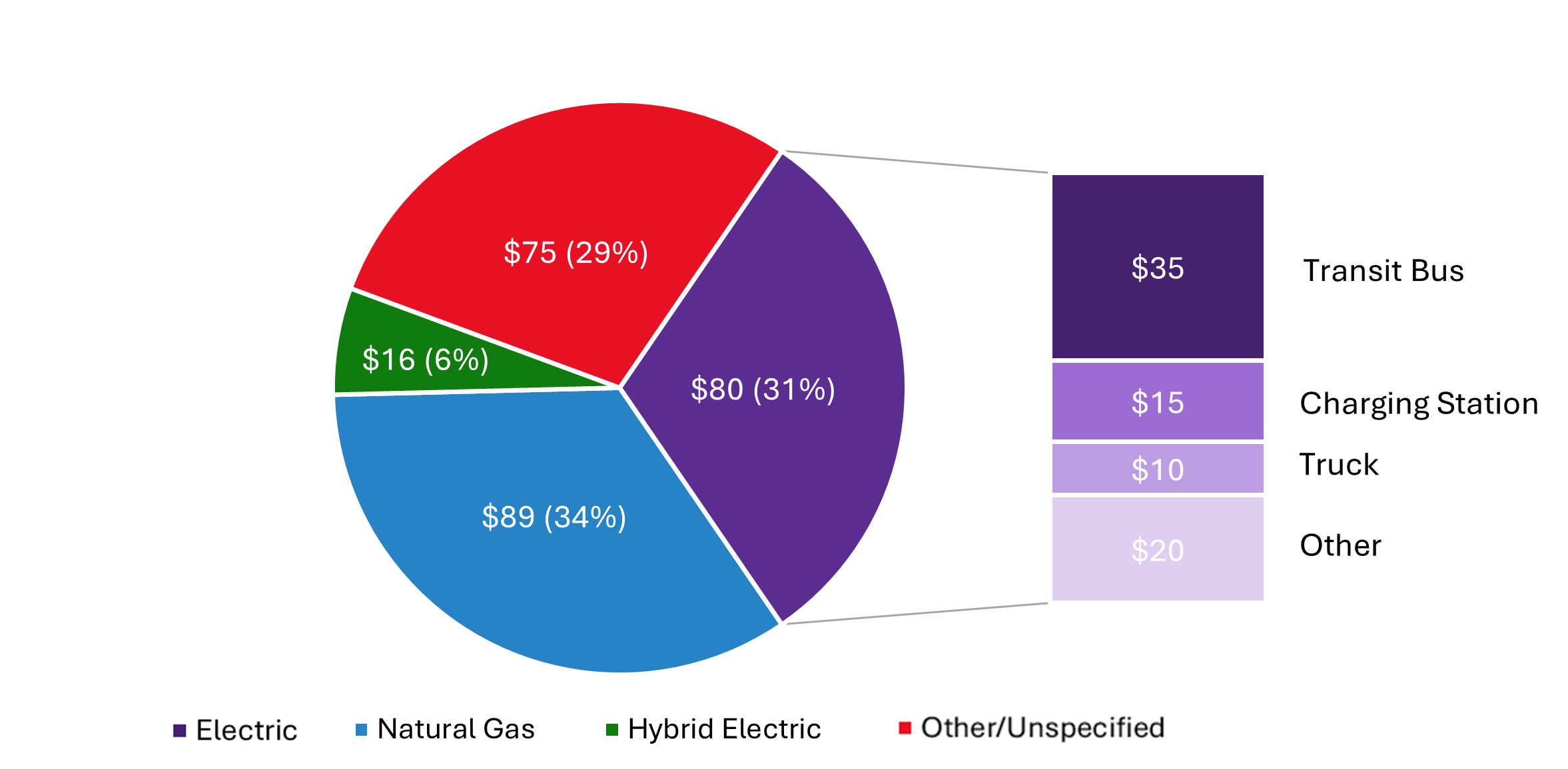

The Alternative Fuels and Vehicles project category has accounted for a total of just $258 million in funding out of the more than $42.2 billion funded by CMAQ to date. Of this $258 million, just over $80 million, or 30 percent of alternative fuels and vehicles funding, has gone towards supporting EVs. Figure 5 shows the breakdown of Alternative Fuels and Vehicles CMAQ funding to date.

Figure 5: CMAQ Alternative Fuels and Vehicles Funding to Date by Fuel Type and Project Type

Source: EV Hub

CMAQ received an additional $13.2 billion in IIJA, and the act explicitly adds “the purchase of medium- or heavy-duty zero emission vehicles and related charging equipment” as an eligible project. Previously, these projects were only eligible if they fit within the category of fuel reduction projects, or as part of a public transit project.

It remains to be seen whether these changes will result in a greater portion of new CMAQ funding going toward electric vehicles.

Diesel Emissions Reduction Act (DERA)

The Environmental Protection Agency’s DERA Program funds grants and rebates to protect human health and improve air quality by reducing emissions from diesel engines. DERA has both formula grants to states as well as competitive national grants and rebates. This analysis focuses exclusively on national DERA funding.

DERA has awarded $76 million for EVs, representing 10 percent of all national DERA funding to date. DERA has funded a wide variety of MDHD EVs lead by school buses, locomotive switchers, and yard tractors. DERA has been appropriated $100 million per year since 2012 and current funding runs through 2024.

Rebuilding American Infrastructure with Sustainability and Equity (RAISE)

The RAISE program (formerly BUILD, and before that, TIGER) offers discretionary grants for surface transportation projects with a significant local or regional impact. RAISE does not primarily fund vehicle electrification, but it may as part of a larger project. For example, in FY 2021, Rockford, Illinois implemented an electric bus circulator route as part of a street reconstruction project and Derby, Connecticut constructed a multimodal transportation center with new electric buses.

To date, just one percent of RAISE funding has gone towards transportation electrification projects. IIJA makes $7.5 billion available for RAISE from FY 2022 to FY 2026 and puts additional emphasis on climate outcomes. On August 11, 2022, the Department of Transportation announced the FY 2022 RAISE awards. Out of 166 projects projects funded in FY 2022, 17 include funding for EVs or EV charging.

Looking forward

The nearly $100 billion of funding eligible to support EV adoption in IIJA and IRA significantly outsizes the $3.3 billion of federal investment in EVs made prior to their passage. The impact of this new funding for electrification paired with continued support from states, utilities, and the private sector will be transformative. Atlas looks forward to tracking this federal funding and analyzing its impact over the next several years.

Explore the data for yourself and keep track of funding awarded through IIJA and IRA on the Public Funding Page of the State Policy Dashboard.

[1] This data story does not cover loan programs or tax credits.

[2] In this data story, ‘EVs’ includes fully battery-electric vehicles, as well as plug-in hybrid vehicles. It does not include fuel cell vehicles.

[3] The Rebuilding American Infrastructure with Sustainability and Equity (RAISE) program was formerly known as the Better Utilizing Investments to Leverage Development (BUILD) Transportation Discretionary Grants program and before that the Transportation Investment Generating Economic Recovery (TIGER) program.

[4] A Retrospective Assessment of Clean Energy Investments in the Recovery Act

Learn More