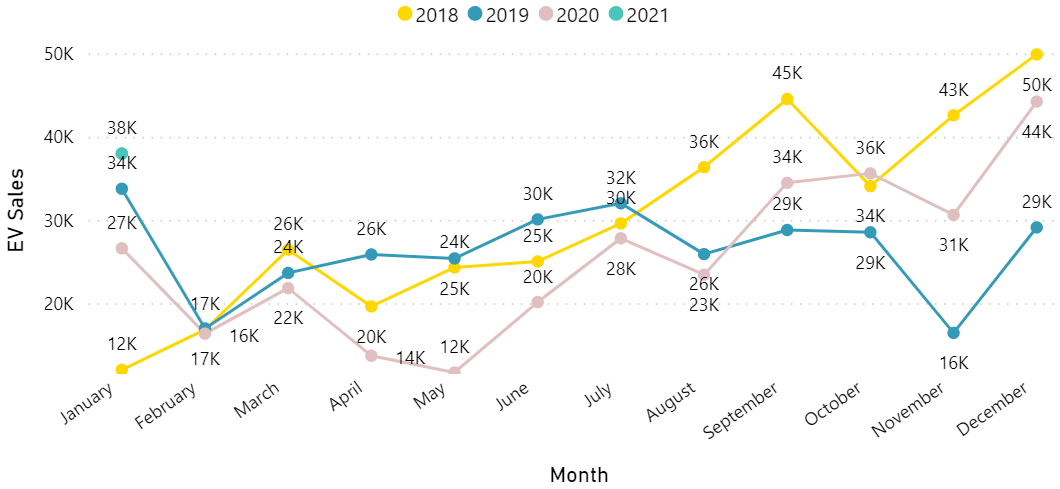

Source: EV Hub

Early indicators from the EV market point to a strong year in the making for 2021. In addition to widespread investment from manufacturers, utilities, and public agencies recorded so far this year, EV sales were up 43 percent in January compared to the same month in 2020. This marks the highest January on record in terms of EV sales, with January 2021 surpassing the previous high point of January 2018 by 12 percent. EV sales rose to a record market share, accounting for three percent of all light-duty vehicle sales recorded in January 2021.

January sales were higher than every month in 2020 besides December, which was the all-time second-highest month for EV sales on record. The uptick in sales in the final quarter of 2020 minimized the EV market contraction for the year with sales down only three percent compared to 2019 levels despite production slowdowns and limited demand resulting from the pandemic. Tesla accounted for 65 percent of the EVs sold in January 2021. Notably, the Tesla Model Y surpassed the Model 3 as the most popular vehicle on the market for the month. The best-selling non-Tesla vehicle continues to be the Chevy Bolt. However, GM sold six times fewer vehicles than the Tesla Model Y in January.

New vehicles continue to enter the market and are becoming increasingly popular. The plug-in hybrid (PHEV) Toyota RAV4 Prime and all-electric Ford Mustang Mach-E, both of which came on the market in the second half of 2020, started ramping up sales in January 2021. Toyota sold more than 850 RAV4 Primes and Ford sold 99 Mustang Mach-Es. Early estimates put the new Mustang’s sales at near 3,700 for the month of February, which would be a 37-fold increase over January figures. This newest offering from Ford is expected to continue gaining market share throughout the year after winning SUV-of-the-year honors and is priced competitively at just under $43,000 not including the federal tax credit.

According to Edmunds, the average new vehicle sale price reached a new high of $40,000 at the end of 2020. A growing number of EVs are falling below that benchmark even without the federal tax credit that can offer price reductions of $7,500 for long-range all-electrics. This includes the redesigned and reduced price Chevy Bolt and Bolt EUV that are forthcoming from General Motors (GM). While GM and Tesla have met the sales threshold for the tax credit to phase out, Ford and all other automakers operating in the United States are still eligible. GM and Tesla could be eligible for the incentive again if new federal legislation proposing to extend the sales threshold for the tax credit is enacted.

The new offerings from GM are just two of the roughly 30 new EVs expected to hit the U.S. market in 2021. While many of these new models have been promised by startups that have not yet completed production facilities and thus could be subject to delays, new PHEV and all-electric offerings from the likes of GM, Fiat-Chrysler, Mercedes-Benz, and Volkswagen are all likely to see their first sales this year. Track all of the upcoming models and sales on the Automakers Dashboard.