Source: New York Times

By Nick Nigro

The passenger EV market has something for everyone right now and reading between the lines reveals that the market is on the verge of a turning point. The extent to which the United States leads or follows during this transition is up to policymakers in Washington, the states, and within cities as we’ve discussed recently.

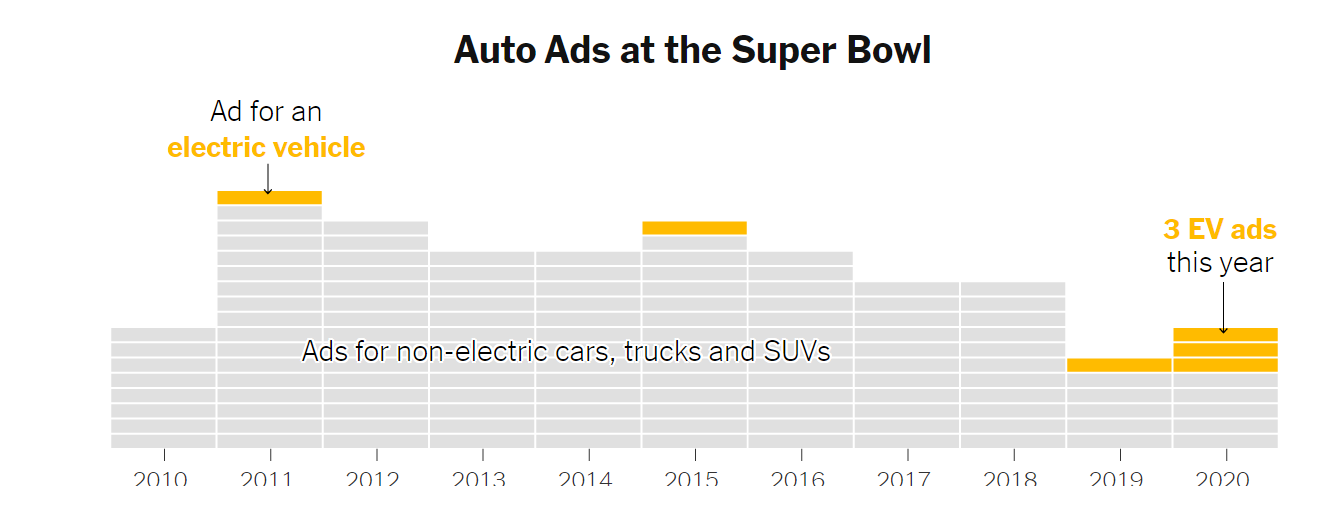

Last night, four automakers spent millions on ads during the Super Bowl to tout their new electric offerings with a focus on EV size and performance rather than the technology’s environmental benefits. Lebron James is the new pitchman for GM’s upcoming 1,000 horsepower electric Hummer, Idris Elba showed Ford’s Mustang EV is worthy of the famous moniker, Maisie Williams from Game of Thrones rode in an Audi E-Tron SUV and encouraged car buyers looking at gasoline vehicles to “let it go,” and Porsche reminded everyone that EVs can keep pace with any gas-powered sportscar. These ads mark a notable shift in the industry’s approach to the EV pitch and are a far cry from the cheesy Super Bowl ad from Nissan in 2011.

The new strategy from the autos makes sense for the U.S. market as Americans continue to show their preference for larger, more powerful vehicles; light trucks and SUVs made up 70 percent of light-duty vehicle sales in 2019 while their share averaged about 50 percent from 2010 to 2015. The Super Bowl ads may have appeased some critics of the industry’s lack of advertising for EVs, but much more is needed before we can expect everyday consumers to have the information they need to decide on buying an EV.

A likely reason for this shift in the industry’s approach to the marketing of EVs is the success of Tesla. As I discussed in my wrap-up of the 2010s, Tesla has proven that full-sized, long-range EVs are not only possible, but are the overwhelming preference for EV buyers. While they did not run any ads in the big game, Tesla is being called a “status symbol” among NFL athletes. The Wall Street Journal recently released a video on how EVs work in markets around the world. When they focused on the charging experience, they described Tesla as an “outlier” because of the company’s substantial investment in a nationwide network of fast charging stations. Indeed, you’d be hard pressed to find a story on “range anxiety” that focuses on Tesla because of their Supercharger network.

The financial markets have long hemmed and hawed about Tesla, sending their stock soaring and crashing as the company met and missed expectations over the years. The wild ride the stock is on at the moment (up 130 percent in the last year) could be a sign that investors are going all-in on all-electrics. With the delivery of their first vehicles in China late last year, Tesla expanded their customer base to include the largest EV market in the world and reduced their dependency on the U.S. market. The company also had a very positive earnings call last week, sending their market capitalization to over $110 billion, or second in the world among all automakers behind only Toyota.

Looking ahead, the EV market is entering a new generation of technology, one that’s bigger, faster, and stronger. While EVs are already cost effective on a total cost ownership basis in certain cases, analysts estimate that some vehicles will even reach price parity within five years. In addition, more fast charging infrastructure is being deployed in anticipation of new longer range EVs thanks to Electrify America, state governments through the Volkswagen Settlement, electric utility programs, and other market players.

For EVs to succeed, they’ll have to check all the boxes for the mainstream car and truck buyer. The good news is action is underway on all fronts that put EVs in a strong place to compete in every segment. The big unknown at this point is the extent to which the United States will lead or follow.