Spencer Burget and I published the third annual “Transportation Electrification in the Southeast” report on Thursday last week. Produced in partnership with the Southern Alliance for Clean Energy (SACE), the report covers EV progress in six states – Alabama, Florida, Georgia, North and South Carolina and Tennessee. There are also one pagers for each of the six states of the Southeast.

This year’s report tracks substantial momentum in the Southeast within the past year across many electric transportation market indicators, as well as specific opportunities for state-by-state policy, economic development, and investment activity related to electric vehicle (EV) manufacturing, deployment of passenger EVs and EV charging, and government and electric utility funding for transportation electrification.

Here are six toplines from this year’s “Transportation Electrification in the Southeast” annual report:

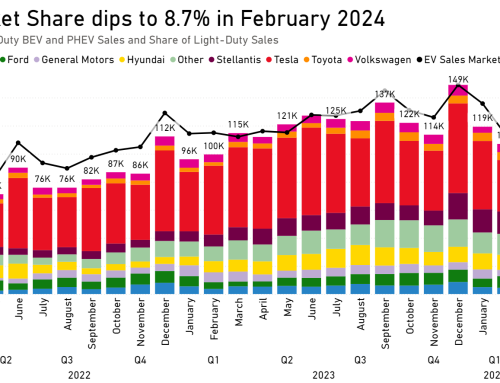

1. Sales: Light-duty EV sales in the Southeast continue to trend upward, accounting for 5 percent of all new light-duty vehicle sales in the region in Q2 2022, up from 2.5 percent in Q2 2021.

2. Manufacturing Employment and Investment: The Southeast’s greatest strength is in EV manufacturing. The region has captured nearly $33 billion in announced investment and more than 40,000 anticipated jobs, including successive announcements to build EVs in Georgia by Rivian and Hyundai, which were each projected to be the largest economic development projects in the state at the time of announcement. More than a third of the nation’s anticipated EV manufacturing jobs will be in the Southeast

3. Charging Deployment: Charging infrastructure deployment continues to grow apace in the region, up 28% over the past year.

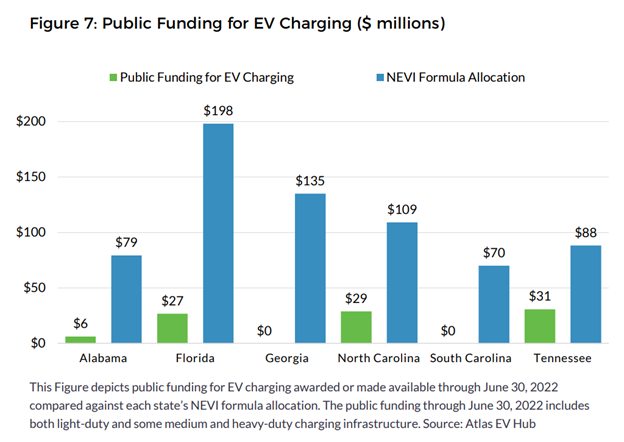

4. Government Funding: Southeast states will receive $680 million in National EV Infrastructure (NEVI) funding, which will far outstrip existing public investments in EV infrastructure (per Figure 7).

5. Policy: Though Florida, North Carolina, South Carolina, and Tennessee engage in electric transportation planning, and North Carolina has set ambitious transportation decarbonization targets, the Southeast policy landscape is not supportive of EV market growth.

6. Utilities: Two Florida investor-owned utilities (IOUs) lead the way in the Southeast for approved EV investment per customer. While Florida Power & Light ($41 per customer) and Duke Energy Florida ($39 per customer) lead the region, all IOUs in the Southeast trail the national average ($43 per customer).

Want to know more? Check out the webinar recording from last week.