Source: EV Hub

If the first three months of the year are any indication, 2021 is shaping up to be a banner year for the U.S. passenger EV market. EV sales shot up by 95 percent in the first quarter compared to 2020 with March sales 2.5 times higher than the same month last year. The 41,627 all-electric and 13,626 plug-in hybrid vehicles sold in March make it the all-time highest month for U.S. passenger EV sales, beating out December 2018 when 49,900 total EVs were sold. EV sales as a share of the total light-duty vehicle market crossed the three percent threshold for the first time in the first quarter. EVs notched an impressive 15 percent share of all passenger vehicle sales for the first quarter.

Executives of America’s leading automakers are heralding a new age for EVs in the United States. It was a big week for Ford, which officially unveiled the F-150 Lightning, hosted President Biden, and announced a new joint venture with SK Innovation last week. The all-electric F-150, the nation’s best-selling vehicle for several decades, is competitively priced with a baseline of around $40,000 and a range between 230 and 300 miles. With President Biden singing its praises, many are expecting this to be a monumental offering in a hot EV market. Ford has proven itself a worthy name in the EV business so far in 2021 with the Mustang Mach-E rising to take the position of third-highest selling non-Tesla BEV in its first full quarter on the market. If the automaker can accelerate whispers of an electric version of the newly relaunched Bronco, the Blue Oval would have three formidable offerings in a U.S. auto market increasingly dominated by pickups, SUVs, and crossovers.

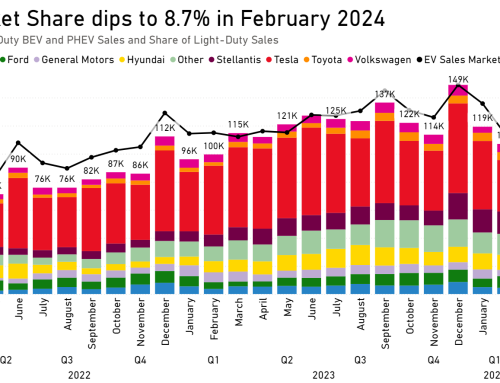

Ford faces stiff competition from EV king Tesla and crosstown rival General Motors. While Tesla’s market share is down 20 percent in the first quarter compared to 2020, the automaker still claimed 55 percent of all U.S. passenger EV sales (and 73 percent of BEV sales). Ford and GM are both racing to build out in-house battery production and have teamed up with rival battery manufacturers to deliver their electric visions. Ford’s partnership and new joint venture with SK Innovation is expected to yield domestic batteries by or before 2025. GM’s two battery facilities in Ohio and Tennessee are a product of their joint venture with LG Chem, which won $1.8 billion through the settlement of a trade dispute with SK Innovation in April. GM’s Chevy Bolt remains the best-selling non-Tesla EV on the market and the automaker is planning to release three new EV models by the end of the year.

Competition from foreign automakers is also heating up with March marking the first sales of Volkswagen’s new ID.4. The crossover, which will eventually be produced alongside batteries at a facility in Tennessee, is expected to do well and has already sold 344 units in its first month on the market. Volkswagen’s luxury sub-brands including Audi and Porsche are also performing well in 2021. Audi ranked fourth among all brands in EV sales in the first quarter of 2021 led by strong sales for the e-tron. Porsche sold more than 1,800 Taycans in the first quarter, outpacing the Tesla Model S which went into a production shutdown earlier this year. While consumers await new all-electric offerings from Toyota, the world’s number three automaker, the company’s popular plug-in hybrid Prius and RAV4 put the automaker in the number two position for U.S. EV sales in the first quarter. You can track this information on the Automakers Dashboard and follow more highlights from the first quarter in our latest Quarterly Review.