Source: Atlas Public Policy

Throughout 2020, increased electric utility and government investment in transportation electrification began to reach areas of the country outside the funding epicenters of California and New York. While both states continued to deepen their lead in all categories of funding, 2020 and the start of 2021 have seen new momentum in smaller EV strongholds like Colorado, Massachusetts, and New Jersey and increasing activity in emerging markets like North Carolina. Both Massachusetts and New Jersey have indicated plans to adopt commitments to electrify all passenger vehicle sales by 2035. In North Carolina, 2020 brough the first major utility approval and Volkswagen Settlement awards for EVs and EV charging. North Carolina was also the only state in the Southeast and one of only three non-ZEV states to adopt the ZEV Bus and Truck MOU in July 2020.

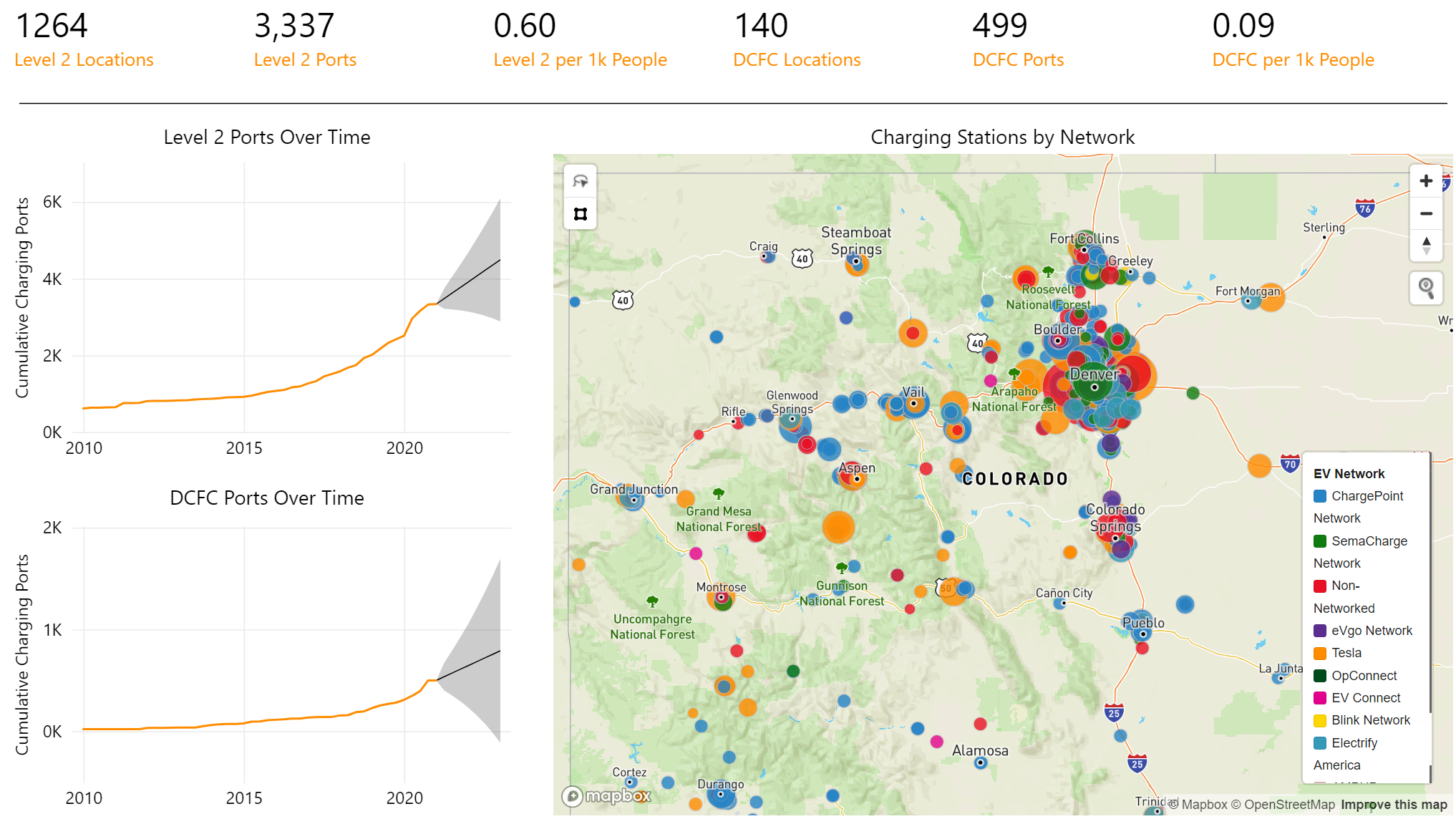

Fellow MOU signatory Colorado continues to exhibit leadership in transportation electrification. Recently, we highlighted the approval of Xcel Energy’s $110 million transportation electrification plan, rocketing the state to the number four spot in terms of cumulative approved utility support for EVs and EV charging. The increasing prospects of vehicle and infrastructure deployment in the state have expanded our collaboration with the Colorado Energy Office to establish a new tool to track the state’s progress towards transportation electrification targets.

We are excited to release EValuateCO! This is new dashboarding tool provides a comprehensive deep dive into the current state and historical trends of transportation electrification in Colorado. The dashboard allows users to view information on EV registrations at the ZIP code level, the location and number of all known non-residential charging stations, and details on charging use for a selected number of Charge Ahead Colorado-funded stations throughout the state. The tool combines information from sources including DMV registrations and U.S. Census Bureau data to show how the market for EVs and usage of EV charging infrastructure is evolving over time.

Based on the information currently available, there are roughly 32,900 EVs on the road in Colorado. The state has a long way to go to reach the deployment target of 940,000 EVs by 2030 outlined in the 2020 Colorado EV Plan. EValuateCO notes the baseline deployment levels in January 2011 to allow for easy comparison of the growth in deployment over time. The tool shows that the number of EVs on the road in Colorado has grown almost 27 percent from about 26,000 at the beginning of 2020. When looking at passenger vehicle sales, Colorado’s EV market was down seven percent between January and November 2020 compared to 2019. Nationwide, EV sales were down nine percent over the same time period, indicating that Colorado is outperforming the national EV market. Colorado is slightly below the national rate of growth in terms of available non-residential charging infrastructure, with the total number of charging ports in Colorado growing from 667 at the end of 2010 to over 3,825 at the start of 2021. Charging station deployment grew at a similar rate at the national level with the number of charging ports increasing by roughly five times between the end of 2010 and 2020.

EValuateCO is the second tool developed by Atlas that provides a deep dive on state-level EV metrics. The first, EValuateNY, was designed in collaboration with the New York State Energy Research and Development Authority (NYSERDA) the Center for Climate and Energy Solutions. We are in the process of upgrading EValuateNY and will be including information on medium- and heavy-duty vehicle electrification in this update. Stay tuned for more detailed tracking of the progress in bus and truck electrification from Atlas in the coming months.