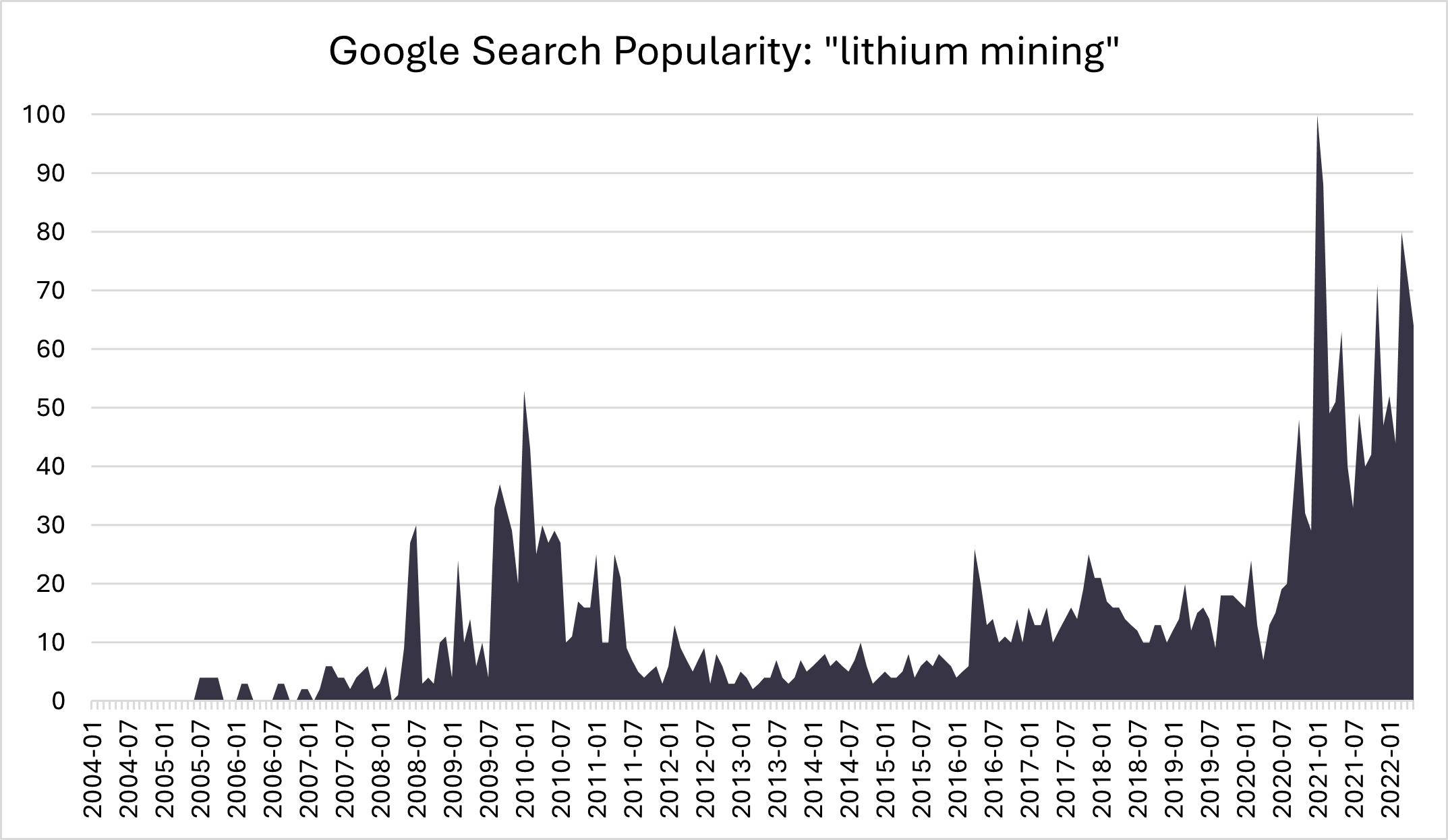

Google search popularity for “lithium mining” since 2004. Source: Google Trends

There is a growing chorus of voices talking about lithium. Elon Musk tweeted in April, “Price of lithium has gone to insane levels! Tesla might actually have to get into the mining & refining directly at scale, unless costs improve. There is no shortage of the element itself, as lithium is almost everywhere on Earth, but pace of extraction/refinement is slow.”

The explosion in interest started in 2021 and has continued since then, as per the Google Trends search results for lithium mining above. We hosted a fascinating conversation on EV Hub Live last week with Abby Wulf from SAFE and Ethan Elkind from UC Berkeley, both of whom are experts on supply chain challenges.

We wrote a few weeks back about critical minerals and the supply chain challenges with electric vehicles, with a focus on lithium, cobalt and nickel. Given that the din surrounding lithium continues to grow louder, let’s take a look at more of what we need to know about the substance that’s often referred to as “white gold.”

The Process

This Department of Energy page provides a useful summary of three key forms of lithium extraction:

1. Hard rock mining (mainly Australia)

2. Brines (mainly South America, North America, Europe)

3. Geothermal extraction (Salton Sea, California and Rhine Valley, Germany)

Lithium must then be processed. Much of this processing takes place in, and much of the mining is controlled by, China. Abby Wulf talked about the challenges with China’s dominance in EV Hub Live last week.

Environmental Justice

There are serious concerns about environmental justice including at the proposed mine at Thacker Pass in Nevada. The concerns are both about mining on Native land as well as water contamination. Longform reporting came out in May about reopening a dormant lithium mine in North Carolina (hard rock mining). The article was titled, The Lithium War Next Door. The Lithium Wars refers to growing local opposition to lithium mines as seen from Chile to Serbia and increasingly in the United States.

More muted opposition has been seen at proposed lithium extraction sites at the Salton Sea in California. The Salton Sea is home to 600,000 tons of lithium. While this form of extraction is greener, it is also more expensive at this stage. Controlled Thermal Resources, one of the companies involved at the Salton Sea has pledged to support 220 jobs early and 1,400 jobs in the longer term. The company has also pledged that 95 percent of those jobs would be sourced locally.

The geothermal form of extraction is much less destructive than hard rock mines. Here’s how it works, “Hot salty water, or geothermal brine, is pumped to the surface and converted to a gas that turns a turbine to generate electricity from heat within the Earth. In addition to electricity production, these geothermal brines can yield lithium, brought up in the brine solution from thousands of feet underground. Geothermal electricity production is already environmentally friendly: It has a small physical footprint, is renewable and weather-independent, and is virtually carbon free.”

US Mining

According to the Mineral Commodity Summaries 2022 from the US Geological Survey, there is just one single lithium mine in operation in the United States – a brine operation in Nevada. There are a bunch of proposed mines at various stages of approval including the mines mentioned above.

Prices Way Up, Consumption Heading that Way

Reporting by Canary Media reflects skyrocketing lithium prices in 2022 – some estimates find that lithium prices have increased 438 percent over the past year. This may threaten the downward trajectory of battery prices over the past few years. The challenge is that bringing more lithium supply onto the market takes time.

Production and consumption also went up, but not nearly as steeply. According to the USGS 2022 Summary for Lithium, “Excluding U.S. production, worldwide lithium production in 2021 increased by 21% to approximately 100,000 tons from 82,500 tons in 2020 in response to strong demand from the lithium-ion battery market and increased prices of lithium. Global consumption of lithium in 2021 was estimated to be 93,000 tons, a 33% increase from 70,000 tons in 2020.”

What next?

There is some movement. Automakers are building partnerships with lithium mines, going further upstream in the supply chain. Tesla in Nevada, GM in California, and BMW in Argentina. Abby and Ethan stressed the importance of international cooperation, standards and partnerships to secure lithium supply chains moving forward and reduce dependence on China.

Battery composition has also changed and will continue to change. The next frontier for many is a solid state battery, which is less reliant on nickel and cobalt. This battery type is expected to be commercially available within two years according to some analysts, but whether or not it can scale is the challenge. Then there are the federal government’s investments through the Infrastructure Investment and Jobs Act.